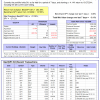

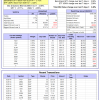

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 7 days, and showing -4.04% return to 10/27/2014. Over the previous week the market value of Best(SPY-SH) gained -3.11% at a time when SPY gained 3.08%.

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 7 days, and showing -4.04% return to 10/27/2014. Over the previous week the market value of Best(SPY-SH) gained -3.11% at a time when SPY gained 3.08%.

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $383,295 which includes $20 cash and excludes $11,409 spent on fees and slippage.

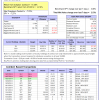

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 95 days, and showing a 5.78% return to 10/27/2014. Over the previous week the market value of iM-Combo3 gained 2.53% at a time when SPY gained 3.08%.

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 95 days, and showing a 5.78% return to 10/27/2014. Over the previous week the market value of iM-Combo3 gained 2.53% at a time when SPY gained 3.08%.

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $115,380 which includes $2,727 in cash and excludes $751 in fees and slippage.

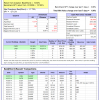

The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained 1.06% at a time when SPY gained 3.08%.

The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained 1.06% at a time when SPY gained 3.08%.

Over the period 1/2/2009 to 10/27/2014 the starting capital of $100,000 would have grown to $110,528 which is net of $15,255 fees and slippage.

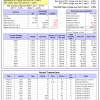

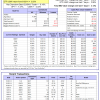

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 6 of them winners, so far held for an average period of 53 days, and showing combined 1.42% average return to 10/27/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.59% at a time when SPY gained 3.08%.

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 6 of them winners, so far held for an average period of 53 days, and showing combined 1.42% average return to 10/27/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.59% at a time when SPY gained 3.08%.

A starting capital of $100,000 at inception of 1/2/2009 would have grown to $798,695 which includes $60 cash and excludes $56,727 spent on fees and slippage.

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 119 days, and showing combined 9.39% average return to 10/27/2014, while the benchmark SPY gained 0.64% and the ETF USMV gained 3.83% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 3.46% at a time when SPY gained 3.08%

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 119 days, and showing combined 9.39% average return to 10/27/2014, while the benchmark SPY gained 0.64% and the ETF USMV gained 3.83% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 3.46% at a time when SPY gained 3.08%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $109,725 which includes $77 cash and $100 for fees and slippage.

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 28 days, and showing combined 1.77% average return to 10/27/2014. Since inception, on 9/29/2014, the model gained 1,77% while the benchmark SPY gained -0.70% and the ETF USMV gained 2.40% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 3.48% at a time when SPY gained 3.08%

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 28 days, and showing combined 1.77% average return to 10/27/2014. Since inception, on 9/29/2014, the model gained 1,77% while the benchmark SPY gained -0.70% and the ETF USMV gained 2.40% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 3.48% at a time when SPY gained 3.08%

A starting capital of $100,000 at inception on 9/29/2014 has grown to $101,773 which includes $31 cash and $100 for fees and slippage.

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 68 days, and showing combined 4.58% average return to 10/27/2014. Since inception, on 6/30/2014, the model gained 10.23% while the benchmark SPY gained 0.64% and the ETF USMV gained 3.83% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.13% at a time when SPY gained 3.08%

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 68 days, and showing combined 4.58% average return to 10/27/2014. Since inception, on 6/30/2014, the model gained 10.23% while the benchmark SPY gained 0.64% and the ETF USMV gained 3.83% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 3.13% at a time when SPY gained 3.08%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $110,226 which includes $54 cash and $332 for fees and slippage.

Leave a Reply

You must be logged in to post a comment.