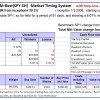

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 91 days, and showing 6.07% return to 7/28/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 91 days, and showing 6.07% return to 7/28/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $418,093 which includes $1,922 cash and excludes $10,605 spent on fees and slippage.

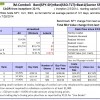

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 121 days, and showing a 10.43% return to 7/28/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 121 days, and showing a 10.43% return to 7/28/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $114,293 which includes $669 in cash and excludes $419 in fees and slippage.

The iM-Best(Short) position for Monday 7/28/2014: CRM and MGM. Over the previous week the market value of Best(Short) lost 0.o4% while SPY gained 0.23%.

The iM-Best(Short) position for Monday 7/28/2014: CRM and MGM. Over the previous week the market value of Best(Short) lost 0.o4% while SPY gained 0.23%.

Over the period 1/2/2009 to 7/21/2014 the starting capital of $100,000 would have grown to $112,601 which is net of $11,756 fees and slippage.

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 7 of them winners, and showing combined 1.71% average return to 7/28/2014

The iM-Best12(USVM)-July-2014 Currently the portfolio holds 12 stocks (6/30/2014), 7 of them winners, and showing combined 1.71% average return to 7/28/2014

A starting capital of $100,000 at inception on 6/30/2014 has grown to $101,711 which includes $1.14 cash and excludes fees and slippage

Leave a Reply

You must be logged in to post a comment.