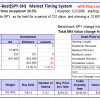

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 231 days, and showing 12.60% return to 2/24/2014

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 231 days, and showing 12.60% return to 2/24/2014

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $390,580 which includes $50 cash and excludes $9,034 spent on fees and slippage.

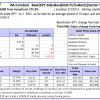

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 16 days, and showing a 4.81% return to 2/20/2014

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 16 days, and showing a 4.81% return to 2/20/2014

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $106,842 which includes $1,169 in cash and excludes $190 in fees and slippage.

How do we know what the allocation is to each fund?

How do I figure out when to sell and buy?

I am new to this service so I haven’t figured it out.

Pete

Pete, Combo3 holds three ETFs more or less equal weight, as one can see from the current holdings in the update. If one wants to follow this model then your allocation should be similar to what is shown.

Best(SPY-SH) is one of the component models of Combo3, one can follow it alone if one is not interested in the other two component models.