Business Cycle Index:

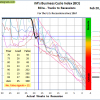

The iM Business Cycle Indicator (BCI) is at 161.9 marginally up from last weeks revised 161.8.

BCIg fell to 11.7 from last week’s 12.8.

The derived off peak indicator BCIp at 50.3, which translated to the BCIw as an equivalent 27 weeks possible lead to a recession with a remote probability of a recession occurring. The BCIw is a weeks to recession indicator read more

The derived off peak indicator BCIp at 50.3, which translated to the BCIw as an equivalent 27 weeks possible lead to a recession with a remote probability of a recession occurring. The BCIw is a weeks to recession indicator read more

The indicators show that is too early to make a recession call.

Hi guys,

Really enjoying your work…Quick Q: do existing home sales incorporate into the BCI or is it another data point that you use?

Related, do you ever update BCI intra week, or stick to the Thursday update?

Many thanks,

Alan

Alan, BCI uses the FRED data series “New One Family Houses Sold: United States” and “New One Family Homes For Sale in the United States”

We have updated only once on a Friday after the housing data become available which caused a significant movement in BCI, otherwise it is updated only on Thursday’s after the insurance claim data has become available. The algorithm of BCI does a significant amount of data smoothing (exponential averaging) so that daily movements would be minimal

Great, many thanks!