|

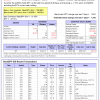

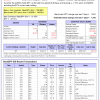

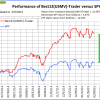

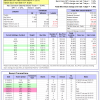

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 49 days, and showing -1.01% return to 2/9/2015. Over the previous week the market value of Best(SPY-SH) gained 1.34% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $358,686 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

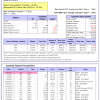

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 147 days, and showing a 7.71% return to 2/9/2015. Over the previous week the market value of iM-Combo3 gained 1.01% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $120,402 which includes $2611 in cash and excludes $1004 in fees and slippage. |

|

|

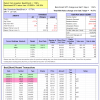

The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained -4.17% at a time when SPY gained 1.34% Over the period 1/2/2009 to 2/9/2015 the starting capital of $100,000 would have grown to $107,468 which is net of $16,891 fees and slippage. |

|

|

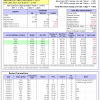

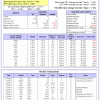

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 35 days, and showing combined 0.47% average return to 2/9/2015. Over the previous week the market value of iM-Best10(S&P 1500) gained 2.40% at a time when SPY gained 1.34% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $821,215 which includes $56 cash and excludes $61,462 spent on fees and slippage. |

|

|

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 8 of them winners, so far held for an average period of 30 days, and showing combined 1.93% average return to 2/9/2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.12% at a time when SPY gained 1.34% A starting capital of $100,000 at inception of 1/15/2015 would have grown to $102,352 which includes $180 cash and excludes $134 spent on fees and slippage. |

|

|

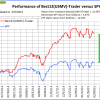

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 12 of them winners, so far held for an average period of 206 days and showing combined 23.62% average return to 2/9/2015. Since inception, on 6/30/2014, the model gained 22.90% while the benchmark SPY gained 5.57% and the ETF USMV gained 10.7% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained 1.08% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,566, which includes $64 cash and $128 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 113 days, and showing combined 12.99% average return to 2/9/2015. Since inception, on 9/29/2014, the model gained 11.99% while the benchmark SPY gained 4.16% and the ETF USMV gained 9.17% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 1.22% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 9/29/2014 has grown to $111,989 which includes $7 cash and $131 for fees and slippage. |

,

|

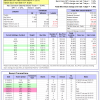

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 9 of them winners, so far held for an average period of 90 days, and showing combined 2.77% average return to 2/9/2015. Since inception, on 6/30/2014, the model gained 21.55% while the benchmark SPY gained 5.57% and the ETF USMV gained 10.70% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.00% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,553 which includes $1,291 cash and $746 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 8 of them winners, so far held for an average period of 160 days, and showing combined 7.44% average return to 2/9/2015. Since inception, on 6/30/2014, the model gained 13.59% while the benchmark SPY gained 5.57% and the VDIGX gained 6.52% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained 1.48% at a time when SPY gained 1.34% A starting capital of $100,000 at inception on 6/30/2014 has grown to $113,593 which includes $237 cash and $302 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.