|

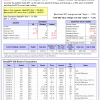

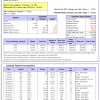

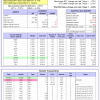

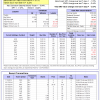

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 42 days, and showing -2.32% return to 2-2-2015. Over the previous week the market value of Best(SPY-SH) gained -1.72% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,938 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

The iM-Combo3 portfolio currently holds SPY, XLV, and SSO so far held for an average period of 140 days, and showing a 6.57% return to 2-2-2015. Over the previous week the market value of iM-Combo3 gained -2.51% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 2/3/2014 would have grown to $119,192 which includes $1600 in cash and excludes $1004 in fees and slippage. |

|

|

The iM-Best(Short) portfolio currently has 2 short positions. Over the previous week the market value of Best(Short) gained 0.94% at a time when SPY gained -1.72% Over the period 1/2/2009 to 2-2-2015 the starting capital of $100,000 would have grown to $112,179 which is net of $16,795 fees and slippage. |

|

|

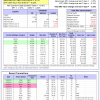

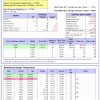

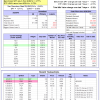

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 3 of them winners, so far held for an average period of 48 days, and showing combined -4.41% average return to 2-2-2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -0.70% at a time when SPY gained -1.72% A starting capital of $100,000 at inception of 1/2/2009 would have grown to $801,963 which includes $20 cash and excludes $50,426 spent on fees and slippage. |

|

|

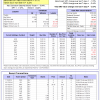

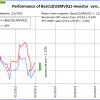

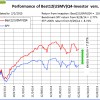

The iM-Best12(USMV)Q1-Investor currently holds 12 stocks, 7 of them winners, so far held for an average period of 23 days, and showing combined 0.80% average return to 2-2-2015. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.87% at a time when SPY gained -1.72% A starting capital of $100,000 at inception of 1/15/2015 would have grown to $101,223 which includes $180 cash and excludes $134 spent on fees and slippage. |

|

|

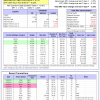

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 199 days and showing combined 22.28% average return to 2-2-2015. Since inception, on 6/30/2014, the model gained 21.58% while the benchmark SPY gained 4.17% and the ETF USMV gained 10.24% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained -2.93% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,566, which includes $64 cash and $128 for fees and slippage. |

|

|

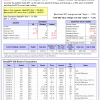

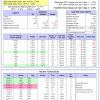

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 106 days, and showing combined 11.62% average return to 2-2-2015. Since inception, on 9/29/2014, the model gained 10.64% while the benchmark SPY gained 2.77% and the ETF USMV gained 8.72% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained -2.32% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 9/29/2014 has grown to $110,636 which includes $7 cash and $131 for fees and slippage. |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 7 of them winners, so far held for an average period of 83 days, and showing combined 1.69% average return to 2-2-2015. Since inception, on 6/30/2014, the model gained 20.36% while the benchmark SPY gained 4.17% and the ETF USMV gained 10.24% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.23% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 6/30/2014 has grown to $120,314 which includes $52 cash and $746 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 185 days, and showing combined 6.83% average return to 2-2-2015. Since inception, on 6/30/2014, the model gained 11.94% while the benchmark SPY gained 4.17% and the VDIGX gained 5.23% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -2.07% at a time when SPY gained -1.72% A starting capital of $100,000 at inception on 6/30/2014 has grown to $111,983 which includes $132 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.