|

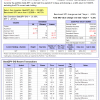

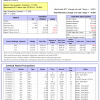

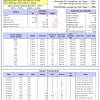

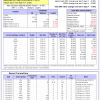

The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 14 days, and showing -2.42% return to 1-5-2015. Over the previous week the market value of Best(SPY-SH) gained -3.35% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,588 which includes $174 cash and excludes $12,136 spent on fees and slippage. |

|

|

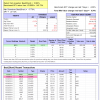

The iM-Combo3 portfolio currently holds SPY, XLV, and TLT so far held for an average period of 123 days, and showing a 6.76% return to 1-5-2015. Over the previous week the market value of iM-Combo3 gained -0.40% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $117,222 which includes $788 in cash and excludes $932 in fees and slippage. |

|

|

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained 0.54 at a time when SPY gained -3.35%. Over the period 1/2/2009 to 1-5-2015 the starting capital of $100,000 would have grown to $110,602 which is net of $16,588 fees and slippage. |

|

|

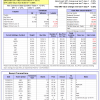

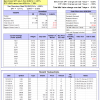

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 46 days, and showing combined -2.53% average return to 1-5-2015. Over the previous week the market value of iM-Best10(S&P 1500) gained -4.32% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $820,030 which includes $32 cash and excludes $59,331 spent on fees and slippage. |

|

|

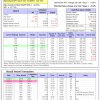

The iM-Best12(USMV)Q1-Investor was launched on 1/5/2015 and currently the portfolio holds 12 stocks. |

|

|

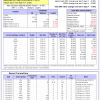

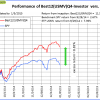

The iM-Best12(USMV)Q3-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 189 days and showing combined 20.48% average return to 1-5-2015. Since inception, on 6/30/2014, the model gained 21.04% while the benchmark SPY gained 4.07% and the ETF USMV gained 8.89% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3-Investor gained -1.99% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,042 which includes $277 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)Q4-Investor Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 98 days, and showing combined 11.39% average return to 1-5-2015. Since inception, on 9/29/2014, the model gained 11.50% while the benchmark SPY gained 2.67% and the ETF USMV gained 7.39% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained -2.31% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $111,501 which includes $149 cash and $100 for fees and slippage. |

,

|

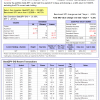

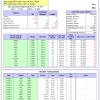

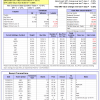

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 67 days, and showing combined 3.08% average return to 1-5-2015. Since inception, on 6/30/2014, the model gained 21.19% while the benchmark SPY gained 4.07% and the ETF USMV gained 8.89% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.82% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $121,189 which includes $46 cash and $618 for fees and slippage. |

,

|

The iM-Best10(VDIGX)-Trader Currently the portfolio holds 10 stocks, 7 of them winners, so far held for an average period of 157 days, and showing combined 8.01% average return to 1-5-2015. Since inception, on 6/30/2014, the model gained 13.12% while the benchmark SPY gained 4.07% and the VDIGX gained 2.62% over the same period. Over the previous week the market value of iM-Best10(VDIGX)-Trader gained -3.00% at a time when SPY gained -3.35%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $113,124 which includes $78 cash and $255 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.