|

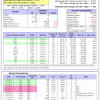

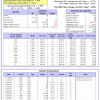

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 42 days, and showing -8.61% return to 12/1/2014. Over the previous week the market value of Best(SPY-SH) gained 0.67% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $367,327 which includes $3 cash and excludes $11,411 spent on fees and slippage. |

|

|

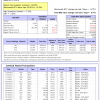

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 130 days, and showing a 9.54% return to 12/1/2014. Over the previous week the market value of iM-Combo3 gained 0.11% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $120,023 which includes $1,692 in cash and excludes $794 in fees and slippage. |

|

|

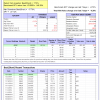

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained -0.26% at a time when SPY gained -0.72%. Over the period 1/2/2009 to 12/1/2014 the starting capital of $100,000 would have grown to $107,138 which is net of $16,271 fees and slippage. |

|

|

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 4 of them winners, so far held for an average period of 47 days, and showing combined -0.40% average return to 12/1/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained 3.11% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception of 1/2/2009 would have grown to $814,790 which includes $465 cash and excludes $58,526 spent on fees and slippage. |

|

|

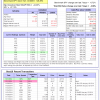

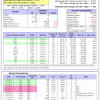

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 154 days and showing combined 18.92% average return to 12/1/2014. Since inception, on 6/30/2014, the model gained 19.31% while the benchmark SPY gained 5.57% and the ETF USMV gained 9.38% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 0.82% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $119,309 which includes $107 cash and $100 for fees and slippage. |

|

|

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 63 days, and showing combined 10.27% average return to 12/1/2014. Since inception, on 9/29/2014, the model gained 10.31% while the benchmark SPY gained 4.16% and the ETF USMV gained 7.87% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 0.85% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception on 9/29/2014 has grown to $110,315 which includes $82 cash and $100 for fees and slippage. |

,

|

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 8 of them winners, so far held for an average period of 54 days, and showing combined 3.85% average return to 12/1/2014. Since inception, on 6/30/2014, the model gained 19.79% while the benchmark SPY gained 5.57% and the ETF USMV gained 9.38% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.13% at a time when SPY gained -0.72%. A starting capital of $100,000 at inception on 6/30/2014 has grown to $119,790 which includes $117 cash and $537 for fees and slippage. |

Leave a Reply

You must be logged in to post a comment.