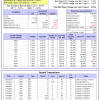

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 21 days, and showing -7.76% return to 11/10/2014. Over the previous week the market value of Best(SPY-SH) gained -1.11% at a time when SPY gained 1.10%.

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 21 days, and showing -7.76% return to 11/10/2014. Over the previous week the market value of Best(SPY-SH) gained -1.11% at a time when SPY gained 1.10%.

A starting capital of $100,000 at inception on 1/2/2009 would have grown to $370,901 which includes $2,015 cash and excludes $11,409 spent on fees and slippage.

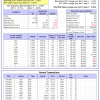

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 109 days, and showing a 8.61% return to 11/10/2014. Over the previous week the market value of iM-Combo3 gained 0.52% at a time when SPY gained 1.10%.

The iM-Combo3 portfolio currently holds SH, XLV, and SSO so far held for an average period of 109 days, and showing a 8.61% return to 11/10/2014. Over the previous week the market value of iM-Combo3 gained 0.52% at a time when SPY gained 1.10%.

The starting capital of $100,000 at inception on 2/3/2014 would have grown to $118,728 which includes $2,546 in cash and excludes $772 in fees and slippage.

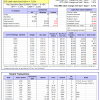

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained -0.03% at a time when SPY gained 1.10%.

The iM-Best(Short) portfolio currently has 1 short positions. Over the previous week the market value of Best(Short) gained -0.03% at a time when SPY gained 1.10%.

Over the period 1/2/2009 to 11/10/2014 the starting capital of $100,000 would have grown to $108,032 which is net of $15,371 fees and slippage.

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 57 days, and showing combined 0.98% average return to 11/10/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained -3.64% at a time when SPY gained 1.10%.

iM-Best10(S&P 1500) portfolio currently holds 10 stocks, 5 of them winners, so far held for an average period of 57 days, and showing combined 0.98% average return to 11/10/2014. Over the previous week the market value of iM-Best10(S&P 1500) gained -3.64% at a time when SPY gained 1.10%.

A starting capital of $100,000 at inception of 1/2/2009 would have grown to $791,591 which includes $46 cash and excludes $57,203 spent on fees and slippage.

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 133 days and showing combined 14.61% average return to 11/10/2014. Since inception, on 6/30/2014, the model gained 14.99% while the benchmark SPY gained 4.65% and the ETF USMV gained 7.55% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 2.51% at a time when SPY gained 1.10%

The iM-Best12(USMV)-July-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 133 days and showing combined 14.61% average return to 11/10/2014. Since inception, on 6/30/2014, the model gained 14.99% while the benchmark SPY gained 4.65% and the ETF USMV gained 7.55% over the same period. Over the previous week the market value of iM-Best12(USMV)-July gained 2.51% at a time when SPY gained 1.10%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $114,989 which includes $107 cash and $100 for fees and slippage.

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 42 days, and showing combined 6.79% average return to 11/10/2014. Since inception, on 9/29/2014, the model gained 6.79% while the benchmark SPY gained 3.26% and the ETF USMV gained 6.07% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 2.32% at a time when SPY gained 1.10%

The iM-Best12(USMV)-October-2014 Currently the portfolio holds 12 stocks, 11 of them winners, so far held for an average period of 42 days, and showing combined 6.79% average return to 11/10/2014. Since inception, on 9/29/2014, the model gained 6.79% while the benchmark SPY gained 3.26% and the ETF USMV gained 6.07% over the same period. Over the previous week the market value of iM-Best12(USMV)-October gained 2.32% at a time when SPY gained 1.10%

A starting capital of $100,000 at inception on 9/29/2014 has grown to $106,789 which includes $31 cash and $100 for fees and slippage.

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 10 of them winners, so far held for an average period of 63 days, and showing combined 8.20% average return to 11/10/2014. Since inception, on 6/30/2014, the model gained 16.38% while the benchmark SPY gained 4.65% and the ETF USMV gained 7.55% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.51% at a time when SPY gained 1.10%

The iM-Best12(USMV)-Trader Currently the portfolio holds 12 stocks, 10 of them winners, so far held for an average period of 63 days, and showing combined 8.20% average return to 11/10/2014. Since inception, on 6/30/2014, the model gained 16.38% while the benchmark SPY gained 4.65% and the ETF USMV gained 7.55% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.51% at a time when SPY gained 1.10%

A starting capital of $100,000 at inception on 6/30/2014 has grown to $116,377 which includes $228 cash and $389 for fees and slippage.

Leave a Reply

You must be logged in to post a comment.