|

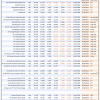

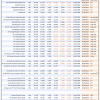

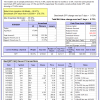

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

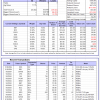

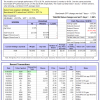

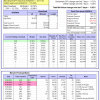

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -9.8%, and for the last 12 months is -13.2%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.28% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $119,673,201 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.60% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $603,982 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 18.3%. Over the same period the benchmark E60B40 performance was 14.8% and 25.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.03% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $171,311 which includes $3,022 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 11.3%, and for the last 12 months is 19.3%. Over the same period the benchmark E60B40 performance was 14.8% and 25.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.03% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $178,502 which includes $3,068 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 20.2%. Over the same period the benchmark E60B40 performance was 14.8% and 25.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.03% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $185,617 which includes $3,291 cash and excludes $4,268 spent on fees and slippage. |

|

|

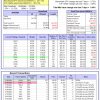

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 632.39% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.18% at a time when SPY gained 0.72%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $180,274 which includes $6,624 cash and excludes $2,447 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 507.35% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 1.09% at a time when SPY gained 0.72%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $151,838 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 994.74% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 2.66% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,094,737 which includes $1,247 cash and excludes $14,389 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 212.26% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.35% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $312,263 which includes $495 cash and excludes $14,326 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 422.11% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.28% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $522,108 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 706.76% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.47% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $806,759 which includes $6,324 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 272.40% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.80% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $372,401 which includes $1,186 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 432.47% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.53% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $532,474 which includes $1,168 cash and excludes $13,938 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 181.27% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.75% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,274 which includes $400 cash and excludes $14,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 322.04% while the benchmark SPY gained 227.11% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.32% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $422,038 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 83.15% while the benchmark SPY gained 69.80% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.40% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $183,154 which includes $891 cash and excludes $00 spent on fees and slippage. |

|

|

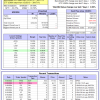

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 29.2%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.60% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $501,360 which includes $1,757 cash and excludes $12,133 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 28.7%, and for the last 12 months is 49.5%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.88% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $78 which includes $137,198 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 24.0%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.24% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $311,542 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 21.9%, and for the last 12 months is 12.5%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.72% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $70,275 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 15.0%, and for the last 12 months is 21.0%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.72% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $209,877 which includes $3,024 cash and excludes $8,264 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 26.3%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Since inception, on 7/1/2014, the model gained 255.42% while the benchmark SPY gained 251.13% and VDIGX gained 178.93% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.02% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $355,417 which includes -$13 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 3.5%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.58% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $265,134 which includes $3,002 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 17.3%, and for the last 12 months is 20.9%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Since inception, on 6/30/2014, the model gained 240.28% while the benchmark SPY gained 251.13% and the ETF USMV gained 197.61% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.46% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $340,281 which includes $1,466 cash and excludes $8,317 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 18.6%, and for the last 12 months is 26.2%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Since inception, on 1/3/2013, the model gained 911.96% while the benchmark SPY gained 384.71% and the ETF USMV gained 384.71% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.56% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,011,957 which includes $472 cash and excludes $11,536 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 12.2%. Over the same period the benchmark BND performance was 4.6% and 11.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.24% at a time when BND gained -0.18%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $145,447 which includes $2,584 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.1%, and for the last 12 months is 24.0%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.24% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $311,542 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 21.7%, and for the last 12 months is 27.7%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.12% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $183,697 which includes $1,288 cash and excludes $4,627 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 25.2%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.05% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,668 which includes $1,496 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.5%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.24% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $212,188 which includes $3,487 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 27.2%, and for the last 12 months is 41.9%. Over the same period the benchmark SPY performance was 21.9% and 36.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.18% at a time when SPY gained 0.72%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $247,463 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.