|

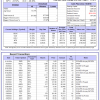

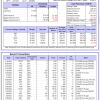

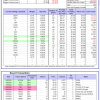

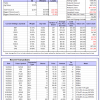

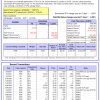

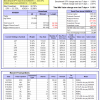

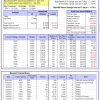

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -15.3%, and for the last 12 months is -22.0%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -3.31% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $112,350,872 which includes $856,605 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -1.69% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $587,111 which includes $6,701 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.6%, and for the last 12 months is 14.8%. Over the same period the benchmark E60B40 performance was 11.3% and 18.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.47% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $169,744 which includes $2,676 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 15.8%. Over the same period the benchmark E60B40 performance was 11.3% and 18.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.47% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $176,866 which includes $2,708 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 11.0%, and for the last 12 months is 16.8%. Over the same period the benchmark E60B40 performance was 11.3% and 18.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.47% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $183,918 which includes $2,916 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 597.76% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.82% at a time when SPY gained -3.06%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $171,616 which includes $5,558 cash and excludes $2,442 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 445.49% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -5.40% at a time when SPY gained -3.06%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $136,373 which includes $860 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 902.07% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -5.18% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,002,066 which includes $30,645 cash and excludes $13,849 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 191.26% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -3.68% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $291,259 which includes $3,373 cash and excludes $14,322 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 402.82% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.49% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $502,821 which includes $2,507 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 667.78% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -3.11% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $767,782 which includes $6,324 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 262.97% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.72% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $362,968 which includes $333 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 407.09% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.18% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $507,092 which includes $1,476 cash and excludes $13,648 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 173.12% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.59% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $273,117 which includes $844 cash and excludes $14,493 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 303.72% while the benchmark SPY gained 210.56% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.94% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $403,725 which includes $2,701 cash and excludes $6,690 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 74.62% while the benchmark SPY gained 61.21% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.07% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $174,623 which includes $45 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.72% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $468,133 which includes $1,263 cash and excludes $12,133 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 22.1%, and for the last 12 months is 50.5%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.50% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $5,065 which includes $137,187 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.74% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,724 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 11.4%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.06% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $66,725 which includes $63 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.47% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $200,432 which includes $2,454 cash and excludes $8,259 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.5%, and for the last 12 months is 18.6%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 249.32% while the benchmark SPY gained 233.37% and VDIGX gained 174.86% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.10% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $349,316 which includes $1,139 cash and excludes $5,084 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.88% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $258,553 which includes $2,098 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Since inception, on 6/30/2014, the model gained 233.02% while the benchmark SPY gained 233.37% and the ETF USMV gained 192.43% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.75% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $333,024 which includes $2,895 cash and excludes $8,260 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 22.8%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Since inception, on 1/3/2013, the model gained 882.32% while the benchmark SPY gained 360.19% and the ETF USMV gained 360.19% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -3.21% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $982,322 which includes $3,112 cash and excludes $11,301 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 10.4%. Over the same period the benchmark BND performance was 4.7% and 9.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.74% at a time when BND gained 1.37%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $146,000 which includes $2,584 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.74% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,724 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 19.4%, and for the last 12 months is 19.7%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.70% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,227 which includes $511 cash and excludes $4,627 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 11.7%, and for the last 12 months is 18.0%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.65% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $181,159 which includes $259 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 17.9%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.75% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $212,996 which includes $3,487 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 21.2%, and for the last 12 months is 30.2%. Over the same period the benchmark SPY performance was 15.7% and 24.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.14% at a time when SPY gained -3.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $235,780 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.