|

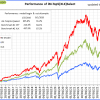

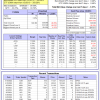

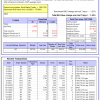

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

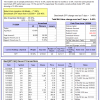

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is -3.3%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -2.43% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $127,353,232 which includes $503,023 cash and excludes $3,077,473 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -1.46% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $552,515 which includes $6,701 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 8.2%. Over the same period the benchmark E60B40 performance was 8.6% and 15.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.99% at a time when SPY gained -0.21%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $161,770 which includes $1,925 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 9.1%. Over the same period the benchmark E60B40 performance was 8.6% and 15.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.99% at a time when SPY gained -0.21%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $168,553 which includes $1,926 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 10.0%. Over the same period the benchmark E60B40 performance was 8.6% and 15.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.99% at a time when SPY gained -0.21%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $175,280 which includes $2,103 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 597.85% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.24% at a time when SPY gained 0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $174,462 which includes $1,686 cash and excludes $2,364 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 479.89% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.81% at a time when SPY gained 0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $144,973 which includes -$148 cash and excludes $1,560 spent on fees and slippage. |

|

|

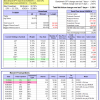

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 979.30% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.19% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,079,301 which includes $2,205 cash and excludes $11,627 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 179.29% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.74% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $279,295 which includes -$774 cash and excludes $13,589 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 377.23% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -3.00% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $477,225 which includes $1,341 cash and excludes $6,601 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 694.80% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.42% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $794,798 which includes $2,573 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 228.15% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.60% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $328,151 which includes $937 cash and excludes $2,200 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 339.97% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.13% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $439,968 which includes $339 cash and excludes $13,415 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 128.52% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.15% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $228,518 which includes $557 cash and excludes $14,001 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 274.65% while the benchmark SPY gained 209.95% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -7.65% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $374,646 which includes $774 cash and excludes $6,524 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 66.66% while the benchmark SPY gained 60.90% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.09% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $166,657 which includes $919 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -2.03% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $457,111 which includes $2,626 cash and excludes $11,858 spent on fees and slippage. |

|

|

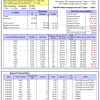

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 8.7%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 5.14% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $14,423 which includes $133,116 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.54% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $292,785 which includes $4,396 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 15.5%, and for the last 12 months is 12.5%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.48% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $66,595 which includes $63 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.49% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,928 which includes $3,600 cash and excludes $8,239 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Since inception, on 7/1/2014, the model gained 227.10% while the benchmark SPY gained 232.72% and VDIGX gained 154.04% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.39% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $327,104 which includes $389 cash and excludes $5,075 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 12.7%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.92% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $256,432 which includes $4,586 cash and excludes $3,348 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.6%, and for the last 12 months is 8.8%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Since inception, on 6/30/2014, the model gained 209.05% while the benchmark SPY gained 232.72% and the ETF USMV gained 171.79% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.68% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $309,054 which includes $1,904 cash and excludes $8,180 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.5%, and for the last 12 months is 20.5%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Since inception, on 1/3/2013, the model gained 817.41% while the benchmark SPY gained 359.29% and the ETF USMV gained 359.29% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.67% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $917,411 which includes $1,635 cash and excludes $11,227 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 0.8%. Over the same period the benchmark BND performance was -1.1% and 2.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.55% at a time when BND gained -1.23%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,671 which includes $1,744 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 11.3%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.54% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $292,785 which includes $4,396 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 7.8%, and for the last 12 months is 6.9%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.08% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $162,722 which includes $1,429 cash and excludes $4,618 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.49% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $163,132 which includes $1,343 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.55% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $199,368 which includes $2,259 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 21.0%. Over the same period the benchmark SPY performance was 15.5% and 24.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.04% at a time when SPY gained 0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $219,432 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.