|

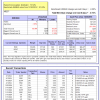

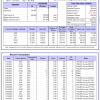

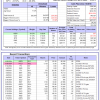

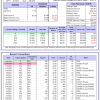

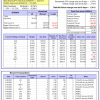

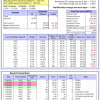

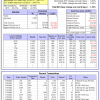

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

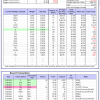

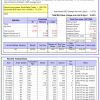

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is -0.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 0.26% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $125,886,067 which includes $2,044,861 cash and excludes $2,951,234 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -1.89% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $550,534 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 9.0%. Over the same period the benchmark E60B40 performance was 6.2% and 17.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.73% at a time when SPY gained -0.26%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $160,169 which includes $705 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 10.0%. Over the same period the benchmark E60B40 performance was 6.2% and 17.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.73% at a time when SPY gained -0.26%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $166,883 which includes $654 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 11.0%. Over the same period the benchmark E60B40 performance was 6.2% and 17.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.73% at a time when SPY gained -0.26%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $173,545 which includes $781 cash and excludes $4,268 spent on fees and slippage. |

|

|

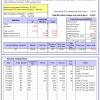

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 590.28% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.13% at a time when SPY gained -0.05%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $172,256 which includes $8,915 cash and excludes $2,301 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 433.30% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.14% at a time when SPY gained -0.05%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $133,324 which includes $522 cash and excludes $1,470 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 971.21% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.84% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,071,211 which includes $4,848 cash and excludes $11,552 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 195.03% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.24% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,028 which includes $1,397 cash and excludes $13,278 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 379.30% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.16% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $479,304 which includes $3,111 cash and excludes $6,567 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 687.95% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.96% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $787,948 which includes $1,894 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 231.94% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.77% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $331,939 which includes $3,718 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 331.01% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -4.39% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $431,011 which includes $4,373 cash and excludes $13,018 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 138.74% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -4.31% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $238,737 which includes $1,550 cash and excludes $13,783 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 271.67% while the benchmark SPY gained 200.16% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.76% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $371,665 which includes $1,535 cash and excludes $6,504 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 68.18% while the benchmark SPY gained 55.81% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.53% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $168,176 which includes $1,972 cash and excludes $00 spent on fees and slippage. |

|

|

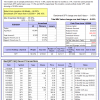

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 21.2%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.82% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $457,927 which includes $2,925 cash and excludes $11,493 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 3.1%, and for the last 12 months is -10.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -4.59% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$1,570 which includes $129,705 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.65% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,073 which includes $2,648 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 3.7%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.05% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $64,486 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 7.0%, and for the last 12 months is 9.4%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.07% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $195,412 which includes $2,443 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Since inception, on 7/1/2014, the model gained 223.95% while the benchmark SPY gained 222.21% and VDIGX gained 154.84% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.61% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $323,948 which includes $1,187 cash and excludes $4,868 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 18.7%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -3.46% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $257,921 which includes $3,593 cash and excludes $3,348 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Since inception, on 6/30/2014, the model gained 198.52% while the benchmark SPY gained 222.21% and the ETF USMV gained 165.87% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -1.33% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $298,523 which includes $118 cash and excludes $8,180 spent on fees and slippage. |

|

|

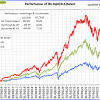

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 28.7%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Since inception, on 1/3/2013, the model gained 813.87% while the benchmark SPY gained 344.77% and the ETF USMV gained 344.77% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.30% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $913,873 which includes $1,940 cash and excludes $10,833 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -1.4%, and for the last 12 months is -0.2%. Over the same period the benchmark BND performance was -1.9% and 2.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.65% at a time when BND gained -0.57%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $135,402 which includes $926 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.65% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $290,073 which includes $2,648 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.40% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,026 which includes $481 cash and excludes $4,614 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 8.3%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.90% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $162,986 which includes $142 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 7.6%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.65% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $197,514 which includes $1,065 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 20.7%. Over the same period the benchmark SPY performance was 11.8% and 28.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -2.86% at a time when SPY gained -0.05%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $222,034 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.