|

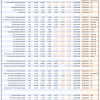

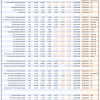

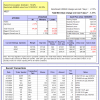

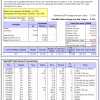

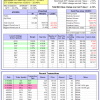

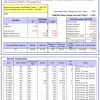

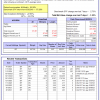

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

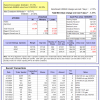

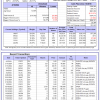

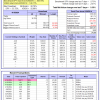

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -3.13% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $130,155,648 which includes $204,343 cash and excludes $2,824,738 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -3.21% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $536,579 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

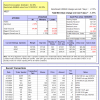

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 7.8%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $157,745 which includes $258 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 9.1%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $164,355 which includes $188 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 10.5%. Over the same period the benchmark E60B40 performance was 2.6% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.37% at a time when SPY gained -2.15%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $170,919 which includes $296 cash and excludes $4,268 spent on fees and slippage. |

|

|

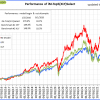

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 525.26% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -3.95% at a time when SPY gained -2.75%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $156,315 which includes $3,242 cash and excludes $2,289 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 380.70% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.03% at a time when SPY gained -2.75%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $120,174 which includes $99 cash and excludes $1,460 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 896.19% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.65% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $996,191 which includes $2,784 cash and excludes $11,552 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 195.25% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -3.58% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,250 which includes $322 cash and excludes $12,570 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 393.85% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.18% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $493,850 which includes $1,696 cash and excludes $6,567 spent on fees and slippage. |

|

|

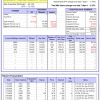

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 607.09% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -3.04% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $707,093 which includes $2,989 cash and excludes $2,149 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 206.11% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.51% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $306,114 which includes $3,075 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 322.15% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.72% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $422,155 which includes $1,079 cash and excludes $12,662 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 128.94% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.83% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $228,940 which includes $2,523 cash and excludes $13,442 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 269.98% while the benchmark SPY gained 185.79% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -3.18% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $369,976 which includes -$371 cash and excludes $6,346 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 57.02% while the benchmark SPY gained 48.36% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.86% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $157,018 which includes $2,401 cash and excludes $00 spent on fees and slippage. |

|

|

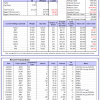

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.26% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $461,669 which includes $2,863 cash and excludes $11,270 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -31.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -2.44% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $02 which includes $129,703 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.29% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,238 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is -2.3%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.76% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $61,392 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

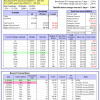

iM-Combo3.R1: The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 3.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.10% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $187,128 which includes $2,267 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.7%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 7/1/2014, the model gained 221.54% while the benchmark SPY gained 206.78% and VDIGX gained 148.17% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.35% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $321,541 which includes $608 cash and excludes $4,868 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.4%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.35% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $259,926 which includes $45,145 cash and excludes $3,173 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 6/30/2014, the model gained 191.26% while the benchmark SPY gained 206.78% and the ETF USMV gained 158.59% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.04% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $291,264 which includes $722 cash and excludes $8,054 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 7.4%, and for the last 12 months is 27.2%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Since inception, on 1/3/2013, the model gained 816.74% while the benchmark SPY gained 323.49% and the ETF USMV gained 323.49% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -4.74% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $916,737 which includes -$1,991 cash and excludes $10,076 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.3%, and for the last 12 months is -2.9%. Over the same period the benchmark BND performance was -3.0% and -0.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.30% at a time when BND gained -1.24%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $134,076 which includes $532 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.1%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.29% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,238 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.17% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,866 which includes $61 cash and excludes $4,301 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -2.0%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -3.41% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,922 which includes $1,383 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.30% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $195,577 which includes $489 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 15.6%, and for the last 12 months is 18.6%. Over the same period the benchmark SPY performance was 6.5% and 24.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.05% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $224,833 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.