|

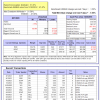

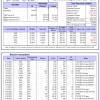

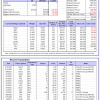

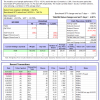

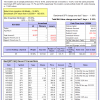

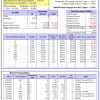

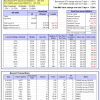

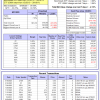

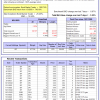

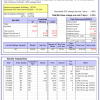

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

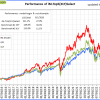

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -2.0%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -1.23% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $140,056,873 which includes $1,658,768 cash and excludes $2,430,028 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.71% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $490,202 which includes $44 cash and excludes $566 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is -3.0%. Over the same period the benchmark E60B40 performance was 9.3% and 2.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.06% at a time when SPY gained -1.52%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,527 which includes $840 cash and excludes $3,255 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.4%, and for the last 12 months is -2.9%. Over the same period the benchmark E60B40 performance was 9.3% and 2.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.06% at a time when SPY gained -1.52%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $151,407 which includes $671 cash and excludes $3,432 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is -2.8%. Over the same period the benchmark E60B40 performance was 9.3% and 2.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.06% at a time when SPY gained -1.52%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $156,161 which includes $671 cash and excludes $3,600 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 371.93% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.48% at a time when SPY gained -1.96%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $117,984 which includes $9,374 cash and excludes $2,042 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 282.13% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -2.37% at a time when SPY gained -1.96%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $95,533 which includes $26 cash and excludes $1,287 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 661.36% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.14% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $761,357 which includes $2,007 cash and excludes $10,610 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 180.40% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.85% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $280,397 which includes -$708 cash and excludes $10,865 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 332.54% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.00% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $432,539 which includes $2,901 cash and excludes $5,948 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 512.90% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.21% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $612,896 which includes $3,825 cash and excludes $1,799 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 166.87% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -2.72% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $266,868 which includes $2,119 cash and excludes $2,009 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 355.45% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.46% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $455,452 which includes $5,944 cash and excludes $11,211 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 113.43% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.79% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $213,429 which includes -$36 cash and excludes $12,337 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 230.73% while the benchmark SPY gained 146.26% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.46% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $330,726 which includes $1,538 cash and excludes $5,408 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 39.21% while the benchmark SPY gained 27.84% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.86% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $139,207 which includes -$587 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 6.4%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.86% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $403,917 which includes $2,353 cash and excludes $10,153 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -16.3%, and for the last 12 months is -2.8%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -8.81% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$5,218 which includes $123,698 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.02% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $254,483 which includes $539 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -9.6%, and for the last 12 months is -15.2%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.16% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $60,473 which includes $9 cash and excludes $2,439 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -6.8%, and for the last 12 months is -9.1%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.10% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $173,397 which includes -$863 cash and excludes $8,079 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -2.2%, and for the last 12 months is -12.0%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of iM-Combo5 gained -0.36% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $149,990 which includes $41 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Since inception, on 7/1/2014, the model gained 193.31% while the benchmark SPY gained 164.35% and VDIGX gained 136.42% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.30% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $293,314 which includes $676 cash and excludes $4,563 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 12.4%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.89% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $244,633 which includes $52 cash and excludes $2,896 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 6.3%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Since inception, on 6/30/2014, the model gained 185.90% while the benchmark SPY gained 164.35% and the ETF USMV gained 135.79% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.28% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $285,903 which includes $2,176 cash and excludes $7,819 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 14.4%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Since inception, on 1/3/2013, the model gained 676.03% while the benchmark SPY gained 264.91% and the ETF USMV gained 264.91% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.13% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $776,033 which includes $2,418 cash and excludes $8,535 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -1.3%, and for the last 12 months is -5.1%. Over the same period the benchmark BND performance was -0.1% and -3.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.00% at a time when BND gained -0.87%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $131,255 which includes $2,980 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.02% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $254,483 which includes $539 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.8%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.67% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,741 which includes $705 cash and excludes $4,015 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.9%, and for the last 12 months is -6.4%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -2.21% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,402 which includes $288 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.4%, and for the last 12 months is -6.1%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -1.02% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,222 which includes $902 cash and excludes $5,764 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 15.7% and 5.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.73% at a time when SPY gained -1.96%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,808 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.