|

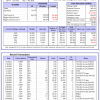

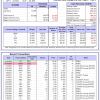

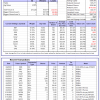

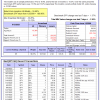

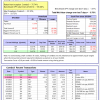

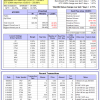

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

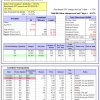

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -18.0%, and for the last 12 months is -20.7%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 2.57% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $126,915,951 which includes $494,619 cash and excludes $2,430,028 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.14% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $507,125 which includes $44 cash and excludes $566 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 2.3%. Over the same period the benchmark E60B40 performance was 9.3% and 8.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.23% at a time when SPY gained 0.97%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,686 which includes -$53 cash and excludes $3,255 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 2.8%. Over the same period the benchmark E60B40 performance was 9.3% and 8.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.22% at a time when SPY gained 0.97%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $153,643 which includes -$254 cash and excludes $3,432 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 6.5%, and for the last 12 months is 3.4%. Over the same period the benchmark E60B40 performance was 9.3% and 8.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.22% at a time when SPY gained 0.97%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $158,469 which includes -$282 cash and excludes $3,600 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 349.74% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.77% at a time when SPY gained 1.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $112,435 which includes -$25 cash and excludes $2,031 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 269.94% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 2.30% at a time when SPY gained 1.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $92,486 which includes $135 cash and excludes $1,280 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 631.13% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 5.05% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $731,135 which includes $8,585 cash and excludes $10,011 spent on fees and slippage. |

|

|

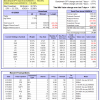

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 148.37% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.88% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $248,369 which includes $658 cash and excludes $10,438 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 312.38% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.30% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $412,378 which includes $3,067 cash and excludes $5,757 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 462.15% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.49% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $562,147 which includes $1,230 cash and excludes $1,799 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 168.47% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.24% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $268,473 which includes $317 cash and excludes $1,992 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 344.12% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.28% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $444,117 which includes -$3,841 cash and excludes $10,620 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 125.31% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.29% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $225,313 which includes $4,193 cash and excludes $11,745 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 208.86% while the benchmark SPY gained 142.26% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.99% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $308,857 which includes $1,981 cash and excludes $5,392 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 36.61% while the benchmark SPY gained 25.76% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.04% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $136,608 which includes $1,604 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.82% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $397,310 which includes $649 cash and excludes $10,022 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 26.5%, and for the last 12 months is -5.6%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -0.89% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $02 which includes $120,821 cash and excludes Gain to date spent on fees and slippage. |

|

|

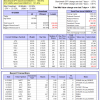

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.20% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $264,329 which includes -$754 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -9.8%, and for the last 12 months is -15.5%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.36% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $60,403 which includes $720 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is -5.3%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.76% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $175,743 which includes -$51 cash and excludes $8,069 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -8.9%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of iM-Combo5 gained -0.57% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $153,634 which includes -$850 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 7.5%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Since inception, on 7/1/2014, the model gained 188.16% while the benchmark SPY gained 160.05% and VDIGX gained 136.49% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.03% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $288,160 which includes $838 cash and excludes $4,484 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.7%, and for the last 12 months is 7.1%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.55% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $226,328 which includes $4,219 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 14.7%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Since inception, on 6/30/2014, the model gained 179.60% while the benchmark SPY gained 160.05% and the ETF USMV gained 131.40% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.53% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $279,601 which includes $555 cash and excludes $7,799 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.4%, and for the last 12 months is 24.3%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Since inception, on 1/3/2013, the model gained 638.44% while the benchmark SPY gained 258.98% and the ETF USMV gained 258.98% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.71% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $738,438 which includes -$65 cash and excludes $8,281 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.5%, and for the last 12 months is 0.7%. Over the same period the benchmark BND performance was 2.4% and -0.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.19% at a time when BND gained 0.07%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,228 which includes $2,327 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 4.9%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.20% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $264,329 which includes -$754 cash and excludes $1,367 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 6.7%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.83% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,914 which includes $33 cash and excludes $3,709 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.6%, and for the last 12 months is 1.3%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.46% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $153,908 which includes -$53 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 7.2%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.20% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,136 which includes -$5 cash and excludes $5,764 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 7.2%, and for the last 12 months is 3.0%. Over the same period the benchmark SPY performance was 13.9% and 13.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.14% at a time when SPY gained 1.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $184,984 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.