|

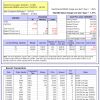

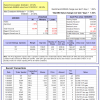

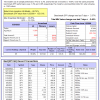

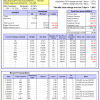

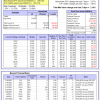

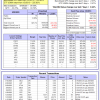

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

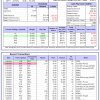

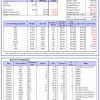

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -18.0%, and for the last 12 months is -12.3%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -1.72% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $126,819,795 which includes -$102,249 cash and excludes $2,179,079 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is -8.4%. Over the same period the benchmark E60B40 performance was 3.2% and -7.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.27% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $141,882 which includes $691 cash and excludes $2,960 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is -8.6%. Over the same period the benchmark E60B40 performance was 3.2% and -7.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.52% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $145,544 which includes $772 cash and excludes $3,126 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is -8.7%. Over the same period the benchmark E60B40 performance was 3.2% and -7.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.77% at a time when SPY gained 1.64%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $149,029 which includes $956 cash and excludes $3,285 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 292.45% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 3.64% at a time when SPY gained 2.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $98,112 which includes -$5,319 cash and excludes $1,904 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 202.30% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 8.00% at a time when SPY gained 2.57%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $75,574 which includes $329 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 527.51% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 6.32% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $627,505 which includes $1,908 cash and excludes $9,482 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 155.14% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.63% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $255,135 which includes $385 cash and excludes $9,941 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 299.73% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.72% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $399,729 which includes $2,830 cash and excludes $5,411 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 411.95% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.94% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $511,954 which includes $1,190 cash and excludes $1,749 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 158.90% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.48% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $258,900 which includes $552 cash and excludes $1,744 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 375.49% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.54% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $475,493 which includes -$6,514 cash and excludes $9,576 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 125.18% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 3.38% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $225,175 which includes $3,006 cash and excludes $11,434 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 192.21% while the benchmark SPY gained 119.89% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.51% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $292,206 which includes $2,578 cash and excludes $5,274 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 22.31% while the benchmark SPY gained 14.14% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.10% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $122,308 which includes $504 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.94% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $383,307 which includes $962 cash and excludes $9,525 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.0%, and for the last 12 months is -29.0%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 10.77% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $10,812 which includes $120,799 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -9.1%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.35% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $261,339 which includes $2,622 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -2.2%, and for the last 12 months is -19.6%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.48% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $65,473 which includes $213 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.56% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $185,689 which includes -$177 cash and excludes $8,064 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -19.4%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of iM-Combo5 gained 1.30% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $158,875 which includes $602 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -4.8%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Since inception, on 7/1/2014, the model gained 175.14% while the benchmark SPY gained 136.04% and VDIGX gained 128.48% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.88% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $275,136 which includes $951 cash and excludes $4,463 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.48% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $225,074 which includes $2,033 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -2.4%, and for the last 12 months is 0.3%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Since inception, on 6/30/2014, the model gained 162.48% while the benchmark SPY gained 136.04% and the ETF USMV gained 123.57% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.19% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $262,481 which includes $666 cash and excludes $7,737 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Since inception, on 1/3/2013, the model gained 584.36% while the benchmark SPY gained 225.83% and the ETF USMV gained 225.83% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.24% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $684,359 which includes $3,060 cash and excludes $7,146 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -5.8%. Over the same period the benchmark BND performance was 2.6% and -6.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.35% at a time when BND gained 0.20%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $137,737 which includes $1,409 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is -9.1%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.35% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $261,339 which includes $2,622 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is -4.4%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.63% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $142,245 which includes $67 cash and excludes $2,823 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is -7.9%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.22% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,905 which includes $603 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -9.0%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 2.54% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $172,171 which includes $2,075 cash and excludes $5,393 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 1.3%. Over the same period the benchmark SPY performance was 3.3% and -9.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 3.35% at a time when SPY gained 2.57%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,952 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.