|

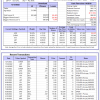

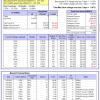

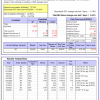

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

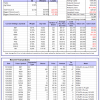

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -11.9%, and for the last 12 months is -10.9%. Over the same period the benchmark E60B40 performance was -13.2% and -12.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.05% at a time when SPY gained 0.04%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,543 which includes $1,433 cash and excludes $2,673 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -12.2%, and for the last 12 months is -11.2%. Over the same period the benchmark E60B40 performance was -13.2% and -12.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.05% at a time when SPY gained 0.04%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $147,605 which includes $1,564 cash and excludes $2,831 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -12.6%, and for the last 12 months is -11.6%. Over the same period the benchmark E60B40 performance was -13.2% and -12.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.05% at a time when SPY gained 0.04%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $151,508 which includes $1,734 cash and excludes $2,982 spent on fees and slippage. |

|

|

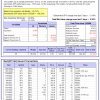

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 290.85% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.64% at a time when SPY gained -0.16%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $97,714 which includes $1,958 cash and excludes $1,835 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 164.13% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.69% at a time when SPY gained -0.16%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $66,033 which includes $311 cash and excludes $1,181 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 498.27% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 1.38% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $598,267 which includes $2,687 cash and excludes $9,478 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 172.57% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.48% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $272,574 which includes $2,468 cash and excludes $9,012 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 286.38% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.52% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $386,378 which includes $1,930 cash and excludes $5,390 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 426.05% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.37% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $526,046 which includes $5,865 cash and excludes $1,738 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 180.19% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.29% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $280,191 which includes $1,671 cash and excludes $1,714 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 413.25% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.27% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $513,252 which includes $1,477 cash and excludes $8,865 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 131.24% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 3.35% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $231,242 which includes $1,394 cash and excludes $10,924 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 206.85% while the benchmark SPY gained 120.93% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.68% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $306,854 which includes $1,498 cash and excludes $5,274 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 26.56% while the benchmark SPY gained 14.69% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.10% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $126,560 which includes $3,235 cash and excludes $00 spent on fees and slippage. |

|

|

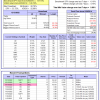

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.30% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $378,399 which includes $1,899 cash and excludes $8,857 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -28.5%, and for the last 12 months is -21.7%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.92% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $120,794 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.7%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.03% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,758 which includes $1,051 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -27.5%, and for the last 12 months is -26.7%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.26% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $64,303 which includes $0 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -13.5%, and for the last 12 months is -13.3%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.18% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,214 which includes $7 cash and excludes $8,054 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -32.9%, and for the last 12 months is -32.5%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of iM-Combo5 gained 0.12% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $152,482 which includes -$964 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -7.8%, and for the last 12 months is -7.4%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Since inception, on 7/1/2014, the model gained 195.25% while the benchmark SPY gained 137.16% and VDIGX gained 146.70% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.89% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $295,250 which includes $504 cash and excludes $4,445 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 7.4%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.20% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $221,678 which includes $2,021 cash and excludes $2,551 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 6.7%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Since inception, on 6/30/2014, the model gained 175.66% while the benchmark SPY gained 137.16% and the ETF USMV gained 135.10% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.97% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $275,655 which includes $188 cash and excludes $7,623 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 27.9%, and for the last 12 months is 32.9%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Since inception, on 1/3/2013, the model gained 634.49% while the benchmark SPY gained 227.38% and the ETF USMV gained 227.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.04% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $734,488 which includes $1,884 cash and excludes $6,959 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -10.9%, and for the last 12 months is -11.1%. Over the same period the benchmark BND performance was -11.7% and -11.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.03% at a time when BND gained 0.33%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $135,323 which includes $581 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -12.7%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.03% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,758 which includes $1,051 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -8.0%, and for the last 12 months is -4.6%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.46% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,161 which includes $79 cash and excludes $2,232 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is -6.2%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.30% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $152,008 which includes $1,631 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -14.0%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.03% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $173,103 which includes $938 cash and excludes $5,043 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is 1.2%. Over the same period the benchmark SPY performance was -15.0% and -14.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.77% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $168,399 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.