|

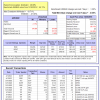

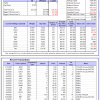

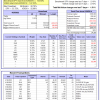

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -8.0%, and for the last 12 months is 1.3%. Over the same period the benchmark E60B40 performance was -9.1% and -0.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.05% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $149,905 which includes $1,118 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -8.4%, and for the last 12 months is 1.4%. Over the same period the benchmark E60B40 performance was -9.1% and -0.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.05% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $154,105 which includes $1,253 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -8.7%, and for the last 12 months is 1.4%. Over the same period the benchmark E60B40 performance was -9.1% and -0.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.05% at a time when SPY gained -1.30%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $158,126 which includes $1,327 cash and excludes $2,374 spent on fees and slippage. |

|

|

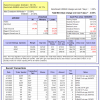

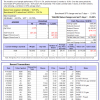

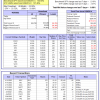

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 368.58% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.66% at a time when SPY gained -2.16%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $117,144 which includes -$3,797 cash and excludes $1,644 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 231.97% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -5.63% at a time when SPY gained -2.16%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $82,993 which includes $181 cash and excludes $1,054 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 473.88% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.24% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $573,879 which includes $143 cash and excludes $8,445 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 192.12% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.95% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $292,119 which includes $377 cash and excludes $8,001 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 285.49% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.88% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $385,493 which includes -$11,262 cash and excludes $4,825 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 453.93% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.00% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $553,932 which includes $2,838 cash and excludes $1,706 spent on fees and slippage. |

|

|

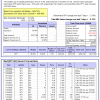

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 188.49% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 3.10% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $288,493 which includes $2,376 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 365.44% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.62% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $465,442 which includes $446 cash and excludes $6,672 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 139.21% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.38% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $239,209 which includes $1,083 cash and excludes $9,119 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 192.55% while the benchmark SPY gained 135.32% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.94% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $292,548 which includes -$415 cash and excludes $4,315 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 26.27% while the benchmark SPY gained 22.15% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.82% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $126,266 which includes $455 cash and excludes $00 spent on fees and slippage. |

|

|

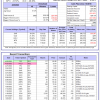

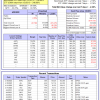

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is -1.4%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.92% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $395,620 which includes $1,768 cash and excludes $7,759 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 11.5%, and for the last 12 months is -0.6%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -15.00% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $32 which includes $95,460 cash and excludes Gain to date spent on fees and slippage. |

|

|

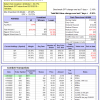

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is -4.1%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.16% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $277,081 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -9.4%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -2.15% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $771,166 which includes $2,847 cash and excludes $25,132 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -9.4%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.24% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $190,729 which includes $1,658 cash and excludes $7,710 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -18.6%, and for the last 12 months is -6.3%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of iM-Combo5 gained -2.30% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $184,962 which includes -$2,924 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -10.4%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Since inception, on 7/1/2014, the model gained 186.88% while the benchmark SPY gained 152.60% and VDIGX gained 147.63% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.51% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $286,879 which includes $211 cash and excludes $4,336 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.48% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $230,877 which includes $1,808 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Since inception, on 6/30/2014, the model gained 170.55% while the benchmark SPY gained 152.60% and the ETF USMV gained 137.48% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.68% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $270,549 which includes $1,661 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 10.6%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Since inception, on 1/3/2013, the model gained 507.88% while the benchmark SPY gained 248.69% and the ETF USMV gained 248.69% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.38% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $607,880 which includes $118 cash and excludes $6,305 spent on fees and slippage. |

|

|

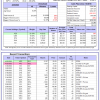

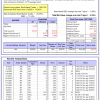

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -6.5%, and for the last 12 months is -5.5%. Over the same period the benchmark BND performance was -8.9% and -8.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.36% at a time when BND gained -0.04%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $142,088 which includes $485 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is -4.1%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -2.16% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $277,081 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.24% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,352 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 10.9%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.13% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,780 which includes $247 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -9.3%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.11% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,467 which includes $4,207 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 8.3%. Over the same period the benchmark SPY performance was -9.5% and 4.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.13% at a time when SPY gained -2.16%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,171 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.