|

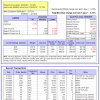

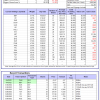

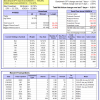

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is 6.5%. Over the same period the benchmark E60B40 performance was -4.4% and 7.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.10% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $153,458 which includes $1,118 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is 6.9%. Over the same period the benchmark E60B40 performance was -4.4% and 7.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.10% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $157,755 which includes $1,253 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.6%, and for the last 12 months is 7.2%. Over the same period the benchmark E60B40 performance was -4.4% and 7.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.10% at a time when SPY gained 0.36%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $161,871 which includes $1,327 cash and excludes $2,374 spent on fees and slippage. |

|

|

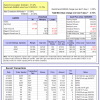

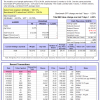

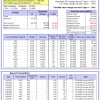

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 418.57% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.13% at a time when SPY gained 0.20%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $129,643 which includes -$1,918 cash and excludes $1,641 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 299.05% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 1.75% at a time when SPY gained 0.20%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $99,763 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 531.12% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.31% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $631,122 which includes $1,147 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 181.41% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.18% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,409 which includes $314 cash and excludes $7,874 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 283.01% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -1.37% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $383,015 which includes $494 cash and excludes $4,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 497.14% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -1.31% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $597,973 which includes $2,180 cash and excludes $1,706 spent on fees and slippage. |

|

|

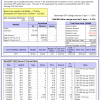

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 174.41% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.42% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $274,407 which includes $1,590 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 391.07% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -0.95% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $491,071 which includes $7,123 cash and excludes $6,641 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 135.77% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.68% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $235,771 which includes $801 cash and excludes $8,983 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 184.61% while the benchmark SPY gained 150.85% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.73% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $284,614 which includes $264 cash and excludes $4,199 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 25.85% while the benchmark SPY gained 30.22% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.26% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $125,849 which includes $1,767 cash and excludes $00 spent on fees and slippage. |

|

|

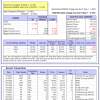

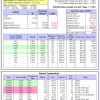

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 4.3%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.94% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $409,006 which includes $1,159 cash and excludes $7,759 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 24.8%, and for the last 12 months is 18.3%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 4.02% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$295 which includes $95,460 cash and excludes Gain to date spent on fees and slippage. |

|

|

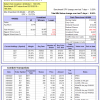

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.20% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,356 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -4.1%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.51% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $816,117 which includes $12,766 cash and excludes $26,754 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.09% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,400 which includes -$121 cash and excludes $7,707 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is 7.9%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of iM-Combo5 gained 0.55% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $202,878 which includes -$1,296 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Since inception, on 7/1/2014, the model gained 200.90% while the benchmark SPY gained 169.28% and VDIGX gained 150.97% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.21% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $301,001 which includes -$21 cash and excludes $4,274 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 7.4%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.59% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $223,866 which includes $2,705 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 7.6%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Since inception, on 6/30/2014, the model gained 170.99% while the benchmark SPY gained 169.28% and the ETF USMV gained 143.90% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.66% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $271,131 which includes $1,694 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 19.6%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Since inception, on 1/3/2013, the model gained 532.40% while the benchmark SPY gained 271.71% and the ETF USMV gained 271.71% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.02% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $632,403 which includes $434 cash and excludes $6,034 spent on fees and slippage. |

|

|

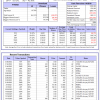

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -3.2%, and for the last 12 months is -1.9%. Over the same period the benchmark BND performance was -6.0% and -4.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.37% at a time when BND gained 0.60%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $146,972 which includes $485 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.20% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $295,356 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.24% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $153,185 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.90% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $167,359 which includes $247 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 15.3%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.19% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $194,236 which includes $4,207 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 14.7%. Over the same period the benchmark SPY performance was -3.5% and 15.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.72% at a time when SPY gained 0.20%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,609 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.