|

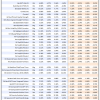

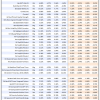

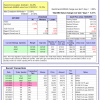

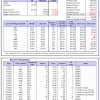

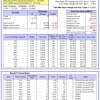

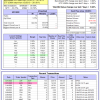

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

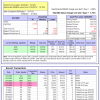

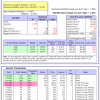

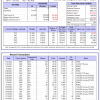

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -5.5%, and for the last 12 months is 8.7%. Over the same period the benchmark E60B40 performance was -6.0% and 7.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.72% at a time when SPY gained 3.96%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $153,842 which includes $694 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.9%, and for the last 12 months is 9.2%. Over the same period the benchmark E60B40 performance was -6.0% and 7.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 4.48% at a time when SPY gained 3.96%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $158,151 which includes $816 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -6.3%, and for the last 12 months is 9.6%. Over the same period the benchmark E60B40 performance was -6.0% and 7.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 5.21% at a time when SPY gained 3.96%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $162,276 which includes $879 cash and excludes $2,374 spent on fees and slippage. |

|

|

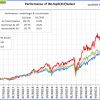

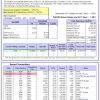

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 392.81% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 11.32% at a time when SPY gained 6.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $123,203 which includes -$1,965 cash and excludes $1,641 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 272.30% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 14.68% at a time when SPY gained 6.90%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $93,075 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 520.24% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 11.08% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $620,238 which includes $1,147 cash and excludes $8,416 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 174.84% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.53% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $274,845 which includes $42 cash and excludes $7,748 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 292.80% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.92% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $392,797 which includes $61 cash and excludes $4,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 499.13% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 5.47% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $599,131 which includes $1,350 cash and excludes $1,706 spent on fees and slippage. |

|

|

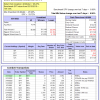

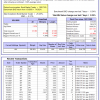

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 169.92% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 4.12% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $269,918 which includes $350 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 397.06% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 6.78% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $497,056 which includes $7,040 cash and excludes $6,641 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 121.84% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.30% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $221,836 which includes $768 cash and excludes $8,970 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 194.31% while the benchmark SPY gained 144.04% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.07% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $294,307 which includes $2,137 cash and excludes $3,948 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.37% while the benchmark SPY gained 26.68% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 4.49% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,370 which includes $2,706 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 6.9%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 5.10% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $410,675 which includes $2,108 cash and excludes $7,640 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 12.2%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.96% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$19,640 which includes $95,438 cash and excludes Gain to date spent on fees and slippage. |

|

|

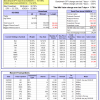

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 6.91% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,339 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

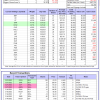

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 15.5%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of Best(SPY-SH) gained 6.89% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $799,638 which includes $2,847 cash and excludes $25,231 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -7.8%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained 9.86% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,210 which includes $5,180 cash and excludes $7,707 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -13.5%, and for the last 12 months is 8.3%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of iM-Combo5 gained 6.96% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $196,533 which includes -$374 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -6.9%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Since inception, on 7/1/2014, the model gained 198.31% while the benchmark SPY gained 161.96% and VDIGX gained 152.97% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 5.78% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $298,314 which includes -$225 cash and excludes $4,274 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 9.3%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.87% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $219,764 which includes $2,040 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 7.1%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Since inception, on 6/30/2014, the model gained 162.21% while the benchmark SPY gained 161.96% and the ETF USMV gained 137.50% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 4.11% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $262,211 which includes $834 cash and excludes $7,436 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 6.8%, and for the last 12 months is 18.5%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Since inception, on 1/3/2013, the model gained 513.82% while the benchmark SPY gained 261.61% and the ETF USMV gained 261.61% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 5.96% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $613,822 which includes $1,590 cash and excludes $5,587 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -4.7%, and for the last 12 months is -2.0%. Over the same period the benchmark BND performance was -6.1% and -4.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 2.09% at a time when BND gained -0.34%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $144,711 which includes -$81 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 6.91% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,339 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -4.5%, and for the last 12 months is 14.3%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 3.96% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,718 which includes $397 cash and excludes $1,393 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -4.4%, and for the last 12 months is 13.8%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.10% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,942 which includes -$549 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 6.75% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $189,073 which includes $4,207 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was -6.1% and 15.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.90% at a time when SPY gained 6.90%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,892 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.