|

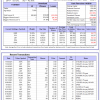

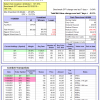

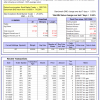

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 16.5%, and for the last 12 months is 19.8%. Over the same period the benchmark E60B40 performance was 14.0% and 16.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.51% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $160,793 which includes $558 cash and excludes $1,786 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 18.3%, and for the last 12 months is 22.0%. Over the same period the benchmark E60B40 performance was 14.0% and 16.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.61% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $165,828 which includes $55 cash and excludes $1,921 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 20.0%, and for the last 12 months is 24.0%. Over the same period the benchmark E60B40 performance was 14.0% and 16.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.70% at a time when SPY gained -0.16%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $170,710 which includes $1,601 cash and excludes $2,047 spent on fees and slippage. |

|

|

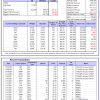

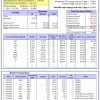

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 472.94% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.70% at a time when SPY gained -0.64%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $143,235 which includes $2,073 cash and excludes $1,563 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 410.60% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.64% at a time when SPY gained -0.64%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $127,651 which includes $1,384 cash and excludes $979 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 585.80% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 1.87% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $685,805 which includes $505 cash and excludes $8,372 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 131.81% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.45% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $231,810 which includes $1,189 cash and excludes $7,048 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 279.93% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -2.02% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $380,883 which includes $2,183 cash and excludes $4,141 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 506.53% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.23% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $606,535 which includes $1,304 cash and excludes $1,675 spent on fees and slippage. |

|

|

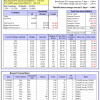

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 183.74% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.35% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $283,736 which includes $991 cash and excludes $1,512 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 380.48% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.59% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $480,481 which includes $1,857 cash and excludes $5,880 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 110.18% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.46% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $210,182 which includes -$982 cash and excludes $8,159 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 251.43% while the benchmark SPY gained 153.45% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -5.02% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $351,615 which includes $934 cash and excludes $3,231 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 25.40% while the benchmark SPY gained 31.57% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.99% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $125,493 which includes $2,197 cash and excludes $00 spent on fees and slippage. |

|

|

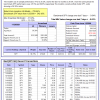

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 18.9%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.20% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $388,674 which includes $3,141 cash and excludes $7,106 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 28.1%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -2.37% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $06 which includes $73,732 cash and excludes Gain to date spent on fees and slippage. |

|

|

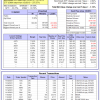

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.94% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,885 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 25.2%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.63% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $829,642 which includes $10,552 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 20.6%, and for the last 12 months is 26.8%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.60% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $207,097 which includes $6,000 cash and excludes $7,307 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 28.0%, and for the last 12 months is 35.5%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of iM-Combo5 gained -0.51% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $227,300 which includes $3,249 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 14.8%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Since inception, on 7/1/2014, the model gained 210.75% while the benchmark SPY gained 172.07% and VDIGX gained 148.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.17% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $310,753 which includes $890 cash and excludes $4,175 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 8.3%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.29% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $204,202 which includes $1,841 cash and excludes $1,899 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 10.9%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Since inception, on 6/30/2014, the model gained 148.66% while the benchmark SPY gained 172.07% and the ETF USMV gained 140.37% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.46% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $248,857 which includes $419 cash and excludes $7,381 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 21.6%, and for the last 12 months is 25.2%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Since inception, on 1/3/2013, the model gained 448.78% while the benchmark SPY gained 275.57% and the ETF USMV gained 275.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.13% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $549,420 which includes $3,060 cash and excludes $5,028 spent on fees and slippage. |

|

|

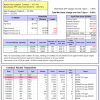

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 3.9%. Over the same period the benchmark BND performance was -1.7% and -1.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.95% at a time when BND gained 0.53%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $151,794 which includes $309 cash and excludes $2,147 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.94% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,885 which includes $4,038 cash and excludes $862 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 12.0%, and for the last 12 months is 14.0%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.32% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,006 which includes $3,479 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 18.6%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.71% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,313 which includes $4,954 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 25.2%, and for the last 12 months is 29.2%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.63% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $196,232 which includes $2,958 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 5.9%. Over the same period the benchmark SPY performance was 25.5% and 29.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.21% at a time when SPY gained -0.64%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,469 which includes $475 cash and excludes $7,877 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.