|

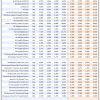

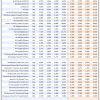

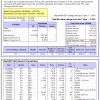

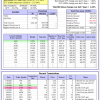

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

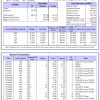

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 26.6%. Over the same period the benchmark E60B40 performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.12% at a time when SPY gained 2.31%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,371 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 29.1%. Over the same period the benchmark E60B40 performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 3.49% at a time when SPY gained 2.31%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $146,853 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is 31.6%. Over the same period the benchmark E60B40 performance was 2.1% and 30.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.84% at a time when SPY gained 2.31%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $150,247 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

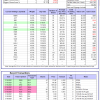

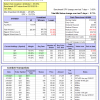

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 434.99% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 8.35% at a time when SPY gained 3.85%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $133,747 which includes -$2,251 cash and excludes $1,325 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 377.43% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 7.15% at a time when SPY gained 3.85%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $119,358 which includes $140 cash and excludes $745 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 442.93% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $543,180 which includes $3,896 cash and excludes $6,460 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 103.89% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $203,889 which includes $650 cash and excludes $5,696 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 249.74% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $349,736 which includes $1,220 cash and excludes $3,273 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 417.50% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $517,747 which includes $2,600 cash and excludes $1,573 spent on fees and slippage. |

|

|

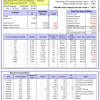

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 162.06% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.42% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,064 which includes $475 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 273.91% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $373,905 which includes $3,086 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 95.74% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $195,739 which includes $1,373 cash and excludes $6,948 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 187.55% while the benchmark SPY gained 114.16% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.84% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,549 which includes $1,748 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 11.35% while the benchmark SPY gained 11.17% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.10% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $111,353 which includes $2,052 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 90.1%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 4.25% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $386,495 which includes $1,190 cash and excludes $6,451 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 15.2%, and for the last 12 months is 118.9%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.16% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 46.7%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 3.82% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $274,188 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

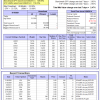

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of Best(SPY-SH) gained 3.83% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $702,226 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 24.0%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.01% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $174,217 which includes $6,389 cash and excludes $6,793 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 41.3%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of iM-Combo5 gained 2.71% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $185,088 which includes $2,929 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 30.5%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Since inception, on 7/1/2014, the model gained 175.24% while the benchmark SPY gained 129.89% and VDIGX gained 74.46% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.51% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $275,237 which includes $1,373 cash and excludes $3,872 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 45.5%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 5.08% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $200,052 which includes $657 cash and excludes $1,637 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 9.2%, and for the last 12 months is 22.5%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Since inception, on 6/30/2014, the model gained 144.94% while the benchmark SPY gained 129.89% and the ETF USMV gained 110.23% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.47% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $245,132 which includes $914 cash and excludes $7,197 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 13.8%, and for the last 12 months is 64.6%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Since inception, on 1/3/2013, the model gained 413.71% while the benchmark SPY gained 217.34% and the ETF USMV gained 217.34% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.05% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $514,376 which includes $1,282 cash and excludes $3,872 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 11.8%. Over the same period the benchmark BND performance was -3.6% and 3.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.54% at a time when BND gained 0.05%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $148,377 which includes $5,096 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 46.7%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 3.82% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $274,188 which includes $2,250 cash and excludes $773 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 17.3%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 2.41% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $130,989 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 6.9%, and for the last 12 months is 32.7%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 4.13% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,618 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.0%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 3.82% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,167 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 23.3%. Over the same period the benchmark SPY performance was 6.0% and 49.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 6.11% at a time when SPY gained 3.85%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,151 which includes $695 cash and excludes $6,396 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.