|

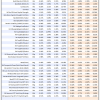

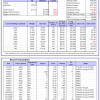

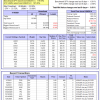

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is 5.7%. Over the same period the benchmark E60B40 performance was 0.4% and 13.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.53% at a time when SPY gained 0.13%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $139,795 which includes $983 cash and excludes $1,783 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 4.8%. Over the same period the benchmark E60B40 performance was 0.4% and 13.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.50% at a time when SPY gained 0.13%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $142,315 which includes $881 cash and excludes $1,918 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 3.9%. Over the same period the benchmark E60B40 performance was 0.4% and 13.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.46% at a time when SPY gained 0.13%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $144,741 which includes $1,068 cash and excludes $2,045 spent on fees and slippage. |

|

|

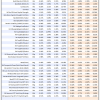

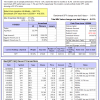

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 406.56% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -0.39% at a time when SPY gained -0.01%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $126,641 which includes $7,998 cash and excludes $1,216 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 377.91% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.83% at a time when SPY gained -0.01%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $119,478 which includes $112 cash and excludes $718 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 437.21% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $537,211 which includes $970 cash and excludes $6,189 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 86.39% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $186,389 which includes $679 cash and excludes $5,310 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 209.66% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $309,660 which includes $997 cash and excludes $3,244 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 395.44% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $495,437 which includes $1,611 cash and excludes $1,573 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 157.51% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.07% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $257,513 which includes $1,300 cash and excludes $1,132 spent on fees and slippage. |

|

|

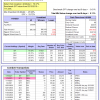

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 291.51% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $391,507 which includes $2,311 cash and excludes $5,042 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 89.57% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $189,569 which includes $2,358 cash and excludes $6,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 170.21% while the benchmark SPY gained 104.56% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.80% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $270,213 which includes $924 cash and excludes $2,742 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 4.87% while the benchmark SPY gained 6.19% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.71% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $104,872 which includes $1,315 cash and excludes $00 spent on fees and slippage. |

|

|

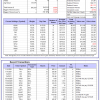

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 36.0%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.73% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $350,885 which includes $1,646 cash and excludes $6,000 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 57.5%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 4.36% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $66,006 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.01% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $670,915 which includes $3,355 cash and excludes $25,118 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 1.0%, and for the last 12 months is -4.3%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.17% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $173,465 which includes $5,665 cash and excludes $6,682 spent on fees and slippage. |

|

|

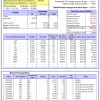

iM-Combo5: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 13.1%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of iM-Combo5 gained 0.11% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $179,651 which includes $1,212 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Since inception, on 7/1/2014, the model gained 166.30% while the benchmark SPY gained 119.59% and VDIGX gained 104.21% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.71% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $266,304 which includes $477 cash and excludes $3,805 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 2.1%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.59% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $188,008 which includes $32,769 cash and excludes $1,592 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.9%, and for the last 12 months is -5.2%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Since inception, on 6/30/2014, the model gained 128.59% while the benchmark SPY gained 119.59% and the ETF USMV gained 107.26% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.01% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $228,593 which includes $2,883 cash and excludes $7,158 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.3%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Since inception, on 1/3/2013, the model gained 352.83% while the benchmark SPY gained 203.12% and the ETF USMV gained 169.30% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.90% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $452,832 which includes $491 cash and excludes $3,625 spent on fees and slippage. |

|

|

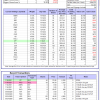

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.6%, and for the last 12 months is -32.3%. Over the same period the benchmark SPY performance was 3.0% and 11.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.51% at a time when BND gained 0.33%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $148,816 which includes $4,060 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -2.6%, and for the last 12 months is -19.5%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of iM-Best(Short) gained -3.46% at a time when SPY gained -0.01%. Over the period 1/2/2009 to 1/19/2021 the starting capital of $100,000 would have grown to $64,004 which includes $77,271 cash and excludes $29,985 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.02% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129,004 which includes $1,546 cash and excludes $1,386 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 0.3%, and for the last 12 months is 2.3%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.04% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $134,841 which includes $2,385 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 1.3%, and for the last 12 months is -5.7%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.01% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,778 which includes $1,260 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -2.9%, and for the last 12 months is 22.0%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.19% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $161,348 which includes $13,893 cash and excludes $5,950 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was 1.3% and 16.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.52% at a time when SPY gained -0.01%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $110,778 which includes $2,594 cash and excludes $2,292 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.