|

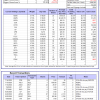

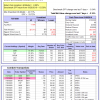

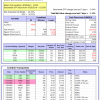

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is 0.3%. Over the same period the benchmark E60B40 performance was 5.1% and 10.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.37% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $125,192 which includes -$3,148 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is -1.5%. Over the same period the benchmark E60B40 performance was 5.1% and 10.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.37% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $125,797 which includes -$3,995 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -7.0%, and for the last 12 months is -3.3%. Over the same period the benchmark E60B40 performance was 5.1% and 10.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.37% at a time when SPY gained -0.12%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $126,323 which includes -$4,799 cash and excludes $1,786 spent on fees and slippage. |

|

|

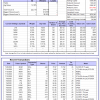

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 326.37% while the benchmark SPY gained 73.18% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -2.26% at a time when SPY gained -0.34%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $106,592 which includes $1,124 cash and excludes $974 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 10.8%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.13% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $279,065 which includes $32,105 cash and excludes $5,205 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -19.9%, and for the last 12 months is -13.8%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.36% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $567,399 which includes -$29,265 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -16.3%, and for the last 12 months is -9.1%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.28% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $148,142 which includes -$1,066 cash and excludes $6,460 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -5.0%, and for the last 12 months is 2.2%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of iM-Combo5 gained -1.29% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $146,368 which includes $3,318 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 11.6%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Since inception, on 7/1/2014, the model gained 146.10% while the benchmark SPY gained 85.90% and VDIGX gained 80.76% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.41% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $246,096 which includes $478 cash and excludes $3,626 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -10.0%, and for the last 12 months is -5.6%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 5.23% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $159,876 which includes $420 cash and excludes $1,396 spent on fees and slippage. |

|

|

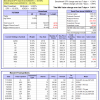

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -10.6%, and for the last 12 months is -3.3%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Since inception, on 6/30/2014, the model gained 110.07% while the benchmark SPY gained 85.90% and the ETF USMV gained 91.67% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.34% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $210,071 which includes $189 cash and excludes $7,078 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.9%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Since inception, on 1/3/2013, the model gained 267.43% while the benchmark SPY gained 156.62% and the ETF USMV gained 149.01% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.21% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $367,433 which includes $961 cash and excludes $3,481 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -36.9%, and for the last 12 months is -38.5%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.92% at a time when BND gained 0.19%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $141,097 which includes $583 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is -7.2%, and for the last 12 months is -6.9%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of iM-Best(Short) gained -0.15% at a time when SPY gained -0.34%. Over the period 1/2/2009 to 7/27/2020 the starting capital of $100,000 would have grown to $74,677 which includes $89,772 cash and excludes $28,142 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 1.4%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.28% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,328 which includes $123 cash and excludes $1,137 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.2%, and for the last 12 months is -0.5%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.48% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,645 which includes $388 cash and excludes $00 spent on fees and slippage. |

|

|

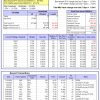

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -20.3%, and for the last 12 months is -15.7%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.26% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $122,219 which includes $3,624 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.5%, and for the last 12 months is -12.2%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.04% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,316 which includes -$11,738 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.0%, and for the last 12 months is 10.2%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.64% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,169 which includes $8,899 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is -6.8%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.06% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $101,400 which includes $24,321 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -36.9%, and for the last 12 months is -38.5%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained -2.15% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $99,339 which includes -$323 cash and excludes $4,169 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -22.7%, and for the last 12 months is -21.3%. Over the same period the benchmark SPY performance was 1.5% and 9.2% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained -1.14% at a time when SPY gained -0.34%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $104,929 which includes -$104 cash and excludes $3,854 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.