|

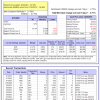

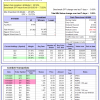

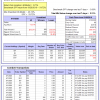

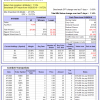

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

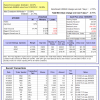

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is 0.8%. Over the same period the benchmark E60B40 performance was 1.0% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.70% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $121,621 which includes -$3,368 cash and excludes $1,528 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is -0.7%. Over the same period the benchmark E60B40 performance was 1.0% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.71% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $122,183 which includes -$4,218 cash and excludes $1,661 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -9.6%, and for the last 12 months is -2.2%. Over the same period the benchmark E60B40 performance was 1.0% and 9.9% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.71% at a time when SPY gained -2.75%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $122,672 which includes -$5,025 cash and excludes $1,786 spent on fees and slippage. |

|

|

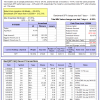

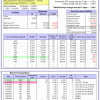

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 289.54% while the benchmark SPY gained 63.80% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.72% at a time when SPY gained -5.00%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $97,385 which includes $60 cash and excludes $965 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -24.5%, and for the last 12 months is -14.7%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -5.28% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $535,027 which includes -$31,787 cash and excludes $25,091 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -19.3%, and for the last 12 months is -11.0%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained 4.52% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $142,915 which includes $506 cash and excludes $6,452 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -11.4%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of iM-Combo5 gained 1.09% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $136,587 which includes $115 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -3.2%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Since inception, on 7/1/2014, the model gained 136.98% while the benchmark SPY gained 75.83% and VDIGX gained 72.40% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -7.58% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $236,978 which includes $1,254 cash and excludes $3,382 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -21.2%, and for the last 12 months is -13.9%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -5.92% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $139,944 which includes $3,852 cash and excludes $1,245 spent on fees and slippage. |

|

|

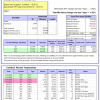

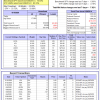

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -12.3%, and for the last 12 months is -0.5%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Since inception, on 6/30/2014, the model gained 106.12% while the benchmark SPY gained 75.83% and the ETF USMV gained 83.33% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -7.82% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $206,119 which includes $2,921 cash and excludes $6,961 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -4.1%, and for the last 12 months is -1.0%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Since inception, on 1/3/2013, the model gained 249.41% while the benchmark SPY gained 142.72% and the ETF USMV gained 138.18% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -8.55% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $349,410 which includes $557 cash and excludes $3,481 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -34.4%, and for the last 12 months is -30.4%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.56% at a time when BND gained 0.62%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $137,943 which includes $14 cash and excludes $2,087 spent on fees and slippage. |

|

|

iM-Best(Short): The model’s out of sample performance YTD is 0.5%, and for the last 12 months is 1.2%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of iM-Best(Short) gained 5.74% at a time when SPY gained -5.00%. Over the period 1/2/2009 to 6/15/2020 the starting capital of $100,000 would have grown to $80,843 which includes $111,987 cash and excludes $27,825 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.1%, and for the last 12 months is 1.7%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.32% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $118,073 which includes $361 cash and excludes $1,014 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -9.6%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -3.63% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $117,294 which includes $1,358 cash and excludes $00 spent on fees and slippage. |

|

|

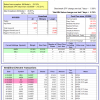

iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is -23.1%, and for the last 12 months is -15.3%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained -8.51% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $117,943 which includes $3,151 cash and excludes $932 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -14.2%, and for the last 12 months is -8.7%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.26% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $140,101 which includes -$11,876 cash and excludes $3,692 spent on fees and slippage. |

|

|

iM-VIX Timer with ZIV: The model’s out of sample performance YTD is -35.0%, and for the last 12 months is -39.1%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained 1.11% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $120,705 which includes $5,358 cash and excludes $8,803 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 14.8%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -3.12% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,374 which includes $8,146 cash and excludes $4,898 spent on fees and slippage. |

|

|

iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is -4.6%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 0.78% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $100,518 which includes $24,179 cash and excludes $1,949 spent on fees and slippage. |

|

|

iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is -34.4%, and for the last 12 months is -30.4%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 2.21% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $103,213 which includes $7,892 cash and excludes $3,972 spent on fees and slippage. |

|

|

iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is -21.1%, and for the last 12 months is -15.1%. Over the same period the benchmark SPY performance was -4.0% and 8.3% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.14% at a time when SPY gained -5.00%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $107,188 which includes $9,260 cash and excludes $3,652 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.