|

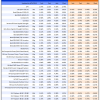

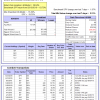

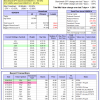

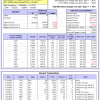

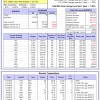

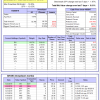

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.5%, and for the last 12 months is 5.1%. Over the same period the benchmark E60B40 performance was 13.5% and 9.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.59% at a time when SPY gained 1.43%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $122,581 which includes $747 cash and excludes $788 spent on fees and slippage. | |

| iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 5.1%. Over the same period the benchmark E60B40 performance was 13.5% and 9.0% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.65% at a time when SPY gained 1.43%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $125,062 which includes $743 cash and excludes $909 spent on fees and slippage. | |

| iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 10.0%, and for the last 12 months is 5.0%. Over the same period the benchmark E60B40 performance was 13.5% and 9.0% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.70% at a time when SPY gained 1.43%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $127,520 which includes $830 cash and excludes $1,024 spent on fees and slippage. | |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 9.6%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.01% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $639,989 which includes -$8,075 cash and excludes $22,629 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is -3.7%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.33% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $162,516 which includes -$532 cash and excludes $5,289 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 1.8%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of iM-Combo5 gained 2.21% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $140,129 which includes $1,743 cash and excludes $0 spent on fees and slippage. | |

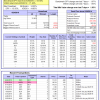

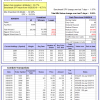

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 18.8%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Since inception, on 7/1/2014, the model gained 117.93% while the benchmark SPY gained 65.58% and VDIGX gained 71.46% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.93% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $217,929 which includes $335 cash and excludes $2,560 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is 15.9%, and for the last 12 months is 14.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of iM-Best7(HiD-LoV) gained -1.05% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $126,730 which includes $37,393 cash and excludes $3,069 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 8.1%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.40% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $162,913 which includes $1,870 cash and excludes $954 spent on fees and slippage. | |

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 23.0%, and for the last 12 months is 17.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Since inception, on 6/30/2014, the model gained 110.89% while the benchmark SPY gained 65.58% and the ETF USMV gained 85.26% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.29% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $210,893 which includes $599 cash and excludes $5,615 spent on fees and slippage. | |

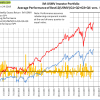

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 24.1%, and for the last 12 months is 19.0%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Since inception, on 1/5/2015, the model gained 103.99% while the benchmark SPY gained 59.12% and the ETF USMV gained 70.13% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 2.43% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $203,988 which includes $461 cash and excludes $1,522 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 22.4%, and for the last 12 months is 19.6%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Since inception, on 3/30/2015, the model gained 70.09% while the benchmark SPY gained 53.44% and the ETF USMV gained 64.32% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 2.28% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $170,093 which includes $320 cash and excludes $1,431 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 20.1%, and for the last 12 months is 12.9%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Since inception, on 7/1/2014, the model gained 100.14% while the benchmark SPY gained 65.58% and the ETF USMV gained 85.26% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.76% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $200,142 which includes $431 cash and excludes $2,021 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 110.73% while the benchmark SPY gained 63.08% and the ETF USMV gained 82.70% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 1.80% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $210,733 which includes -$572 cash and excludes $1,839 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 54.49% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is -11.3%, and for the last 12 months is -10.4%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of iM-Best(Short) gained -0.21% at a time when SPY gained 1.97%. Over the period 1/2/2009 to 6/24/2019 the starting capital of $100,000 would have grown to $78,983 which includes $78,983 cash and excludes $25,908 spent on fees and slippage. | |

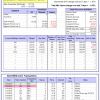

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 7.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.03% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $117,054 which includes $780 cash and excludes $670 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.61% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $121,426 which includes $629 cash and excludes $00 spent on fees and slippage. | |

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 17.4%, and for the last 12 months is 5.4%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 1.51% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $141,066 which includes $5,737 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 10.9%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.96% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $156,592 which includes $1,256 cash and excludes $2,780 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 9.7%, and for the last 12 months is -9.3%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.57% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $198,328 which includes $1,115 cash and excludes $5,544 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 16.9%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 2.72% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $128,294 which includes $542 cash and excludes $2,889 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is 11.0%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained 1.61% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,985 which includes $21 cash and excludes $887 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is 14.4%, and for the last 12 months is 8.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained 0.81% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $116,698 which includes $11,771 cash and excludes $1,058 spent on fees and slippage. | |

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 11.0%, and for the last 12 months is -13.4%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 3.05% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $153,773 which includes $285 cash and excludes $2,795 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 9.8%, and for the last 12 months is -0.5%. Over the same period the benchmark SPY performance was 18.6% and 9.0% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 1.84% at a time when SPY gained 1.97%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $128,763 which includes $10 cash and excludes $2,670 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.