|

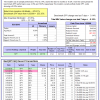

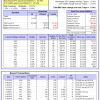

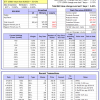

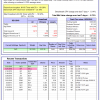

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.15% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $578,510 which includes -$7,596 cash and excludes $17,694 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is 5.1%, and for the last 12 months is 22.6%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.16% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $166,110 which includes -$1,460 cash and excludes $3,891 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-Combo5 gained -0.40% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $133,794 which includes $13 cash and excludes $926 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.1%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 80.26% while the benchmark SPY gained 50.49% and VDIGX gained 43.89% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.13% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,965 which includes $99 cash and excludes $2,177 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -8.8%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained -0.42% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,181 which includes -$157 cash and excludes $2,464 spent on fees and slippage. | |

| iM-Best7(HiD-LoV): The model’s out of sample performance YTD is -7.6%, and for the last 12 months is -1.2%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 0.09% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $104,766 which includes $1,373 cash and excludes $1,780 spent on fees and slippage. | |

| iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 24.9%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.98% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $150,464 which includes $570 cash and excludes $704 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 0.6%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-BestogaX5-System gained 1.11% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 3/28/2016 would have grown to $107,751 which includes $408 cash and excludes $1,150 spent on fees and slippage. | |

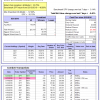

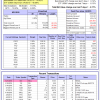

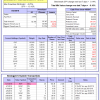

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Since inception, on 6/30/2014, the model gained 78.09% while the benchmark SPY gained 50.49% and the ETF USMV gained 52.54% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $177,863 which includes $185 cash and excludes $4,247 spent on fees and slippage. | |

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is 23.5%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Since inception, on 1/5/2015, the model gained 70.46% while the benchmark SPY gained 44.62% and the ETF USMV gained 40.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.17% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $170,411 which includes $55 cash and excludes $1,170 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is 4.8%, and for the last 12 months is 16.2%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Since inception, on 3/30/2015, the model gained 42.16% while the benchmark SPY gained 39.45% and the ETF USMV gained 35.30% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 0.52% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 3/30/2015 would have grown to $142,156 which includes $278 cash and excludes $976 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is 0.8%, and for the last 12 months is 11.5%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Since inception, on 7/1/2014, the model gained 79.06% while the benchmark SPY gained 50.49% and the ETF USMV gained 52.54% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -0.26% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $179,055 which includes $358 cash and excludes $1,486 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/29/2014, the model gained 84.92% while the benchmark SPY gained 48.21% and the ETF USMV gained 50.43% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.46% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 9/29/2014 would have grown to $184,921 which includes $271 cash and excludes $1,306 spent on fees and slippage. | |

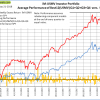

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 42.36% over SPY. (see iM-USMV Investor Portfolio) | |

| iM-Best(Short): The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -3.6%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of iM-Best(Short) gained -0.10% at a time when SPY gained 0.14%. Over the period 1/2/2009 to 5/21/2018 the starting capital of $100,000 would have grown to $91,365 which includes $109,891 cash and excludes $24,071 spent on fees and slippage. | |

| iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 1.5%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,617 which includes $1,285 cash and excludes $115 spent on fees and slippage. | |

| iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -5.2%, and for the last 12 months is 0.9%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.35% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $105,121 which includes $3,960 cash and excludes $00 spent on fees and slippage. | |

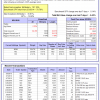

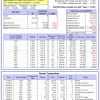

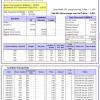

| iM-Composite (SH-RSP) Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SH-RSP) Timer gained 0.61% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $132,238 which includes $2,714 cash and excludes $513 spent on fees and slippage. | |

| iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 2.8%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.14% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $137,087 which includes $2,042 cash and excludes $1,390 spent on fees and slippage. | |

| iM-VIX Timer with ZIV: The model’s out of sample performance YTD is 14.7%, and for the last 12 months is 63.7%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-VIX Timer with ZIV gained -0.73% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $201,864 which includes -$2,530 cash and excludes $2,427 spent on fees and slippage. | |

| iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 3.7%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.60% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $127,592 which includes $53 cash and excludes $1,955 spent on fees and slippage. | |

| iM-Low Turnover Composite Timer Combo: The model’s out of sample performance YTD is -0.6%, and for the last 12 months is 6.1%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Low Turnover Composite Timer Combo gained -0.38% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 3/24/27 would have grown to $106,449 which includes $1,986 cash and excludes $74 spent on fees and slippage. | |

| iM-Min Drawdown Combo: The model’s out of sample performance YTD is -2.3%, and for the last 12 months is 5.7%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Min Drawdown Combo gained -0.16% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $105,377 which includes $3,032 cash and excludes $246 spent on fees and slippage. | |

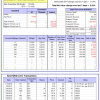

| iM-5ETF Trader (includes leveraged ETFs): The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 34.6%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-5ETF Trader (includes leveraged ETFs) gained 0.90% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $172,910 which includes $1,298 cash and excludes $1,030 spent on fees and slippage. | |

| iM-Standard 5ETF Trader (excludes leveraged ETFs): The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 2.8% and 16.9% respectively. Over the previous week the market value of the iM-Standard 5ETF Trader (excludes leveraged ETFs) gained 0.48% at a time when SPY gained 0.14%. A starting capital of $100,000 at inception on 10/30/2016 would have grown to $128,293 which includes $2,520 cash and excludes $880 spent on fees and slippage. |

iM-Best Reports – 5/21/2018

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.