|

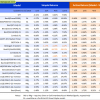

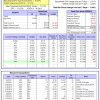

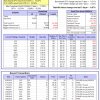

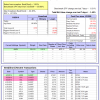

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

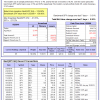

| iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 18.2%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.20% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $419,924 which includes $18 cash and excludes $14,506 spent on fees and slippage. | |

| iM-Combo3.R1: The model’s out of sample performance YTD is -7.6%, and for the last 12 months is 0.4%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.08% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $122,294 which includes $620 cash and excludes $2,662 spent on fees and slippage. | |

| iM-Combo5: The model’s out of sample performance from inception is -1.4%. The benchmark SPY performance over the same period is 8.9%. Over the previous week the market value of iM-Combo5 gained -0.86% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $98,578 which includes $45 cash and excludes $132 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient The model’s out of sample performance YTD is 8.2%, and for the last 12 months is 10.3%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -0.44% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $481,892 which includes $2,088 cash and excludes $6,294 spent on fees and slippage. | |

| iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 3.7%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Since inception, on 7/1/2014, the model gained 30.69% while the benchmark SPY gained 10.07% and the ETF VDIGX gained 14.31% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.46% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $130,695 which includes $128 cash and excludes $1,080 spent on fees and slippage. | |

| iM-BESTOGA-3: The model’s out of sample performance YTD is 7.6%, and for the last 12 months is 37.0%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of iM-BESTOGA-3 gained 1.30% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $197,657 which includes $17,365 cash and excludes $767 spent on fees and slippage. | |

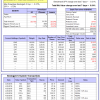

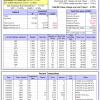

| iM-Best10(Short Russell3000): The model’s performance YTD is -29.4%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of iM-Best10(Short Russell3000) gained -3.11% at a time when SPY gained -0.31%. Over the period 2/3/2014 to 5/2/2016 the starting capital of $100,000 would have grown to $10,030 which includes $19,507 cash and excludes $1,158 spent on fees and slippage. | |

| iM-BestogaX5-System: The model’s out of sample performance from inception is -3.9%. The benchmark SPY performance over the same period is 2.3%. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 0.54% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $96,062 which includes $20,770 cash and excludes $82 spent on fees and slippage. | |

| iM-Best3x4(S&P 500 Min Vol): The model’s out of sample performance YTD is -1.5%, and since inception 1.2%. Over the same period the benchmark SPY performance was 2.5% and 0.3% respectively. Over the previous week the market value of iM-Best3x4 gained -2.10% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $101,176 which includes $467 cash and excludes $1,131 spent on fees and slippage. | |

| iM-Best2x4(S&P 500 Min Vol): The model’s out of sample performance YTD is 3.2%, and since inception 1.9%. Over the same period the benchmark SPY performance was 2.5% and 0.4% respectively. Over the previous week the market value of iM-Best2x4 gained -1.00% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $101,920 which includes $163 cash and excludes $812 spent on fees and slippage. | |

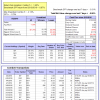

| iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Since inception, on 7/1/2014, the model gained 34.83% while the benchmark SPY gained 10.07% and the ETF USMV gained 22.86% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.67% at a time when SPY gained -0.31%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $134,834 which includes $257 cash and excludes $1,842 spent on fees and slippage. | |

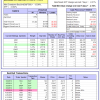

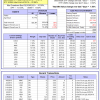

| iM-Best12(USMV)Q1-Investor: The model’s out of sample performance YTD is -4.0%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was -9.0% and -7.9% respectively. Since inception, on 1/5/2015, the model gained 0.17% while the benchmark SPY gained -6.18% and the ETF USMV gained 1.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.18% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $100,167 which includes -$69 cash and excludes $371 spent on fees and slippage. | |

| iM-Best12(USMV)Q2-Investor: The model’s out of sample performance YTD is -4.2%, and since inception -4.7%. Over the same period the benchmark SPY performance was -9.0% and -8.4% respectively. Since inception, on 3/31/2015, the model gained -4.68% while the benchmark SPY gained -9.53% and the ETF USMV gained -1.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -1.02% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $95,321 which includes $43 cash and excludes $211 spent on fees and slippage. | |

| iM-Best12(USMV)Q3-Investor: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is -8.7%. Over the same period the benchmark SPY performance was -9.0% and -7.9% respectively. Since inception, on 7/1/2014, the model gained 13.16% while the benchmark SPY gained -2.37% and the ETF USMV gained 11.04% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 0.54% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $113,158 which includes -$10 cash and excludes $547 spent on fees and slippage. | |

| iM-Best12(USMV)Q4-Investor: Since inception, on 9/30/2014, the model gained 8.03% while the benchmark SPY gained -3.68% and the ETF USMV gained 9.51% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.51% at a time when SPY gained -4.25%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $108,029 which includes -$106 cash and excludes $468 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 19.51% over SPY. (see iM-USMV Investor Portfolio) | |

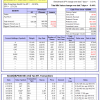

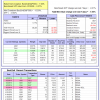

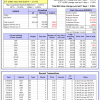

| iM-Best(Short): The model’s out of sample performance YTD is -0.8%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was 2.5% and 0.8% respectively. Over the previous week the market value of iM-Best(Short) gained -1.48% at a time when SPY gained -0.31%. Over the period 1/2/2009 to 5/2/2016 the starting capital of $100,000 would have grown to $103,849 which includes $125,049 cash and excludes $18,893 spent on fees and slippage. |

iM-Best Reports – 5/2/2016

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.