|

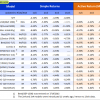

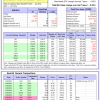

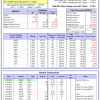

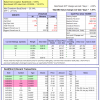

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. |

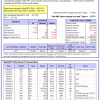

| The iM-Best(SPY-SH) model currently holds SPY, so far held for a period of 35 days, and showing a -1.00% return to 9/28/2015. Over the previous week the market value of Best(SPY-SH) gained -3.97% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $386,107 which includes $30,580 cash and excludes $13,610 spent on fees and slippage. | |

| The iM-Combo3 model currently holds SPY, SSO, and XLP, so far held for an average period of 23 days, and showing a -3.41% return to 9/28/2015. Over the previous week the market value of iM-Combo3 gained -4.64% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $120,371 which includes $901 cash and excludes $1,550 spent on fees and slippage. | |

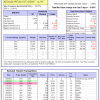

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 4 of them winners, so far held for an average period of 134 days, and showing a 1.43% return to 9/28/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -6.51% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $426,045 which includes $614 cash and excludes $5,110 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 2 of them winners, so far held for an average period of 143 days, and showing a -4.88% return to 9/28/2015. Since inception, on 7/1/2014, the model gained 12.75% while the benchmark SPY gained -1.59% and the ETF VDIGX gained 0.45% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -3.39% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $112,752 which includes $203 cash and excludes $650 spent on fees and slippage. | |

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 0 of them winners, so far held for an average period of 11 days, and showing a -3.65% return to 9/28/2015. Over the previous week the market value of iM-Best10 gained -8.20% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $740,914 which includes -$4,645 cash and excludes $83,093 spent on fees and slippage. | |

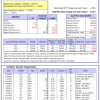

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 6 stocks, 0 of them winners, so far held for an average period of 45 days, and showing a 1.37% return to 9/28/2015. Over the previous week the market value of iM-Best3x4 gained -8.23% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $94,627 which includes -$1,300 cash and excludes $334 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 4 stocks, 0 of them winners, so far held for an average period of 36 days, and showing a 0.20% return to 9/28/2015. Over the previous week the market value of iM-Best2x4 gained -8.09% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $90,019 which includes $1,163 cash and excludes $235 spent on fees and slippage. | |

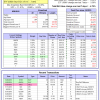

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 1 of them winners, so far held for an average period of 89 days, and showing a -9.39% return to 9/28/2015. Since inception, on 7/1/2014, the model gained 14.10% while the benchmark SPY gained -1.59% and the ETF USMV gained 6.86% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -4.95% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $114,096 which includes $102 cash and excludes $1,301 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 204 days, and showing a -4.31% return to 9/28/2015. Since inception, on 1/5/2015, the model gained -2.02% while the benchmark SPY gained -5.43% and the ETF USMV gained -1.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -4.79% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $97,984 which includes $22 cash and excludes $227 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 1 of them winners, so far held for an average period of 158 days, and showing a -12.04% return to 9/28/2015. Since inception, on 3/31/2015, the model gained -8.73% while the benchmark SPY gained -8.81% and the ETF USMV gained -5.22% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -4.04% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $91,272 which includes $16 cash and excludes $134 spent on fees and slippage. | |

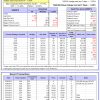

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 3 of them winners, so far held for an average period of 64 days, and showing a -6.86% return to 9/28/2015. Since inception, on 7/1/2014, the model gained 11.70% while the benchmark SPY gained -1.59% and the ETF USMV gained 6.86% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -3.70% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $111,703 which includes $107 cash and excludes $439 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 240 days, and showing a -0.76% return to 9/28/2015. Since inception, on 9/30/2014, the model gained 3.58% while the benchmark SPY gained -2.91% and the ETF USMV gained 5.38% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -3.97% at a time when SPY gained -4.30%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $103,581 which includes $61 cash and excludes $232 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 16.68% over SPY. (see iM-USMV Investor Portfolio) | |

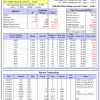

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained 1.87% at a time when SPY gained -4.30%. Over the period 1/2/2009 to 9/28/2015 the starting capital of $100,000 would have grown to $109,838 which includes $153,683 cash and excludes $20,476 spent on fees and slippage. |

iM-Best Reports – 9/28/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.