|

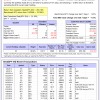

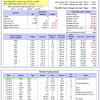

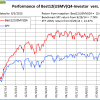

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 147 days, and showing a -2.80% return to 8/3/2015. Over the previous week the market value of Best(SPY-SH) gained -1.51% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $353,187 which includes $19 cash and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 277 days, and showing a 8.12% return to 8/3/2015. Over the previous week the market value of iM-Combo3 gained 0.65% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,941 which includes $2,614 cash and excludes $1,242 spent on fees and slippage. | |

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 6 of them winners, so far held for an average period of 231 days, and showing a 14.05% return to 8/3/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained 1.62% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $463,583 which includes $953 cash and excludes $4,683 spent on fees and slippage. | |

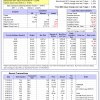

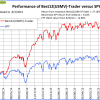

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 9 of them winners, so far held for an average period of 175 days, and showing a 7.99% return to 8/3/2015. Since inception, on 7/1/2014, the model gained 24.55% while the benchmark SPY gained 9.24% and the ETF VDIGX gained 9.70% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.36% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $124,547 which includes $52 cash and excludes $450 spent on fees and slippage. | |

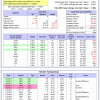

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 4 of them winners, so far held for an average period of 7 days, and showing a -0.84% return to 8/3/2015. Over the previous week the market value of iM-Best10 gained 3.74% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $783,765 which includes -$1,592 cash and excludes $73,026 spent on fees and slippage. | |

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 7 stocks, 5 of them winners, so far held for an average period of 16 days, and showing a 0.36% return to 8/3/2015. Over the previous week the market value of iM-Best3x4 gained 2.65% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $100,360 which includes $461 cash and excludes $37 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 4 stocks, 1 of them winners, so far held for an average period of 18 days, and showing a -0.43% return to 8/3/2015. Over the previous week the market value of iM-Best2x4 gained 3.16% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $99,411 which includes $239 cash and excludes $29 spent on fees and slippage. | |

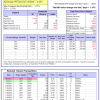

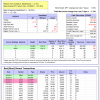

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 6 of them winners, so far held for an average period of 73 days, and showing a 0.41% return to 8/3/2015. Since inception, on 7/1/2014, the model gained 27.18% while the benchmark SPY gained 9.24% and the ETF USMV gained 14.96% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.77% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $127,181 which includes $259 cash and excludes $1,196 spent on fees and slippage. | |

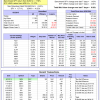

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 156 days, and showing a 2.86% return to 8/3/2015. Since inception, on 1/5/2015, the model gained 7.50% while the benchmark SPY gained 4.98% and the ETF USMV gained 5.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.80% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $107,499 which includes $55 cash and excludes $190 spent on fees and slippage. | |

| The iM-Best12(USMV)Q2-Investor model currently holds 13 stocks, 7 of them winners, so far held for an average period of 116 days, and showing a -4.02% return to 8/3/2015. Since inception, on 3/31/2015, the model gained 2.51% while the benchmark SPY gained 1.23% and the ETF USMV gained 1.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained 1.88% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $102,512 which includes $7,501 cash and excludes $106 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 37 days, and showing a -1.38% return to 8/3/2015. Since inception, on 7/1/2014, the model gained 22.63% while the benchmark SPY gained 9.24% and the ETF USMV gained 14.96% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained 1.48% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $122,631 which includes -$11 cash and excludes $388 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 267 days, and showing a 11.00% return to 8/3/2015. Since inception, on 9/30/2014, the model gained 15.42% while the benchmark SPY gained 7.78% and the ETF USMV gained 13.37% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained 0.92% at a time when SPY gained 1.45%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $115,418 which includes $228 cash and excludes $157 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 17.90% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 2 position(s). Over the previous week the market value of iM-Best(Short) gained -1.74% at a time when SPY gained 1.45%. Over the period 1/2/2009 to 8/3/2015 the starting capital of $100,000 would have grown to $102,039 which includes $142,797 cash and excludes $19,483 spent on fees and slippage. |

iM-Best Reports – 8/3/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.