|

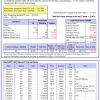

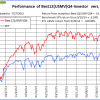

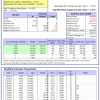

The iM-Best(SPY-SH) model currently holds SH, so far held for a period of 140 days, and showing a -1.31% return to 7/27/2015. Over the previous week the market value of Best(SPY-SH) gained 2.86% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $358,594 which includes $19 and excludes $12,862 spent on fees and slippage. |

| The iM-Combo3 model currently holds SH, TLT, and XLV, so far held for an average period of 270 days, and showing a 7.25% return to 7/27/2015. Over the previous week the market value of iM-Combo3 gained 0.93% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $123,137 which includes $2,614 and excludes $1,242 spent on fees and slippage. | |

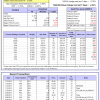

| The iM-Best8(S&P500 Min Vol)Tax-Efficient model currently holds 8 stocks, 5 of them winners, so far held for an average period of 221 days, and showing a 12.65% return to 7/27/2015. Over the previous week the market value of iM-Best8(S&P 500)Tax-Eff. gained -2.28% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $457,714 which includes $2,469 and excludes $4,683 spent on fees and slippage. | |

| The iM-Best10(VDIGX)-Trader model currently holds 10 stocks, 6 of them winners, so far held for an average period of 168 days, and showing a 4.47% return to 7/27/2015. Since inception, on 7/1/2014, the model gained 0.00% while the benchmark SPY gained 0.00% and the ETF VDIGX gained 700.00% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.43% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $120,494 which includes $52 and excludes $450 spent on fees and slippage. | |

| The iM-Best10(S&P 1500) model currently holds 10 stocks, 3 of them winners, so far held for an average period of 4 days, and showing a -2.39% return to 7/27/2015. Over the previous week the market value of iM-Best10 gained -2.57% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $755,522 which includes $627 and excludes $72,003 spent on fees and slippage. | |

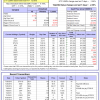

| The iM-Best3x4(S&P 500 Min Vol) model currently holds 7 stocks, 0 of them winners, so far held for an average period of 12 days, and showing a -2.21% return to 7/27/2015. Over the previous week the market value of iM-Best3x4 gained -1.74% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $97,773 which includes $255 and excludes $00 spent on fees and slippage. | |

| The iM-Best2x4(S&P 500 Min Vol) model currently holds 4 stocks, 0 of them winners, so far held for an average period of 11 days, and showing a -3.62% return to 7/27/2015. Over the previous week the market value of iM-Best2x4 gained -2.64% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $96,369 which includes -$106 and excludes $00 spent on fees and slippage. | |

| The iM-Best12(USMV)-Trader model currently holds 12 stocks, 5 of them winners, so far held for an average period of 98 days, and showing a -0.17% return to 7/27/2015. Since inception, on 7/1/2014, the model gained 24.97% while the benchmark SPY gained 7.68% and the ETF USMV gained 12.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -2.39% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $124,966 which includes $397 and excludes $1,106 spent on fees and slippage. | |

| The iM-Best12(USMV)Q1-Investor model currently holds 12 stocks, 7 of them winners, so far held for an average period of 149 days, and showing a -0.24% return to 7/27/2015. Since inception, on 1/5/2015, the model gained 5.60% while the benchmark SPY gained 3.47% and the ETF USMV gained 3.46% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -2.20% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 1/5/2015 would have grown to $105,597 which includes $340 and excludes $190 spent on fees and slippage. | |

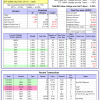

| The iM-Best12(USMV)Q2-Investor model currently holds 12 stocks, 6 of them winners, so far held for an average period of 119 days, and showing a -5.87% return to 7/27/2015. Since inception, on 3/31/2015, the model gained 0.62% while the benchmark SPY gained -0.22% and the ETF USMV gained -0.07% over the same period. Over the previous week the market value of iM-Best12(USMV)Q2 gained -1.94% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 3/31/2015 would have grown to $100,616 which includes $6,888 and excludes $99 spent on fees and slippage. | |

| The iM-Best12(USMV)Q3-Investor model currently holds 12 stocks, 5 of them winners, so far held for an average period of 65 days, and showing a -1.87% return to 7/27/2015. Since inception, on 7/1/2014, the model gained 20.84% while the benchmark SPY gained 7.68% and the ETF USMV gained 12.66% over the same period. Over the previous week the market value of iM-Best12(USMV)Q3 gained -2.74% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $120,844 which includes $467 and excludes $344 spent on fees and slippage. | |

| The iM-Best12(USMV)Q4-Investor model currently holds 12 stocks, 9 of them winners, so far held for an average period of 260 days, and showing a 7.42% return to 7/27/2015. Since inception, on 9/30/2014, the model gained 14.37% while the benchmark SPY gained 6.24% and the ETF USMV gained -100.00% over the same period. Over the previous week the market value of iM-Best12(USMV)Q4 gained -2.57% at a time when SPY gained -2.73%. A starting capital of $100,000 at inception on 9/30/2014 would have grown to $114,369 which includes $6,745 and excludes $151 spent on fees and slippage. | |

| Average Performance of iM-Best12(USMV)Q1+Q2+Q3+Q4-Investor resulted in an excess return of 17.69% over SPY. (see iM-USMV Investor Portfolio) | |

| The iM-Best(Short) model currently holds 4 position(s). Over the previous week the market value of iM-Best(Short) gained 2.27% at a time when SPY gained -2.73%. Over the period 1/2/2009 to 7/27/2015 the starting capital of $100,000 would have grown to $104,070 which includes $182,755 and excludes $19,132 spent on fees and slippage. |

iM-Best Reports – 7/27/2015

Posted in pmp SPY-SH

Leave a Reply

You must be logged in to post a comment.