|

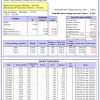

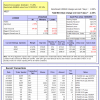

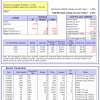

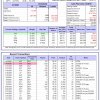

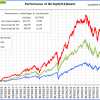

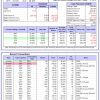

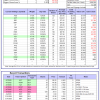

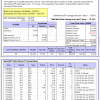

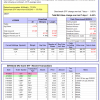

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

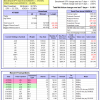

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 4.0%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 4.46% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $139,627,820 which includes $2,280,319 cash and excludes $3,754,277 spent on fees and slippage. |

|

|

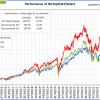

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -9.76% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $539,264 which includes $16,078 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 3.0%. Over the same period the benchmark E60B40 performance was -7.4% and 1.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.38% at a time when SPY gained -6.09%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $164,765 which includes -$1,605 cash and excludes $4,552 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is 2.7%. Over the same period the benchmark E60B40 performance was -7.4% and 1.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -2.38% at a time when SPY gained -6.09%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $171,285 which includes -$2,278 cash and excludes $4,781 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -5.3%, and for the last 12 months is 2.5%. Over the same period the benchmark E60B40 performance was -7.4% and 1.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.39% at a time when SPY gained -6.09%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $177,698 which includes -$2,933 cash and excludes $5,001 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 524.96% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -9.53% at a time when SPY gained -9.83%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $155,251 which includes $961 cash and excludes $2,554 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 447.69% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -8.41% at a time when SPY gained -9.83%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $130,474 which includes -$6,723 cash and excludes $1,770 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 824.69% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -11.20% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $924,693 which includes $36,282 cash and excludes $17,671 spent on fees and slippage. |

|

|

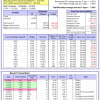

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 152.89% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -12.81% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $252,889 which includes $2,230 cash and excludes $15,036 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 362.51% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -9.35% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $462,515 which includes $3,872 cash and excludes $7,602 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 614.75% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -11.89% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $714,753 which includes $2,710 cash and excludes $2,390 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 252.48% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -6.58% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $352,478 which includes $740 cash and excludes $2,516 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 352.08% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -7.70% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $452,077 which includes $741 cash and excludes $16,650 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 170.33% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -6.81% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $270,326 which includes $1,359 cash and excludes $16,509 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 266.03% while the benchmark SPY gained 189.39% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -6.24% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $366,035 which includes -$3,035 cash and excludes $7,210 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 59.22% while the benchmark SPY gained 50.22% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -8.96% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $159,220 which includes $1,308 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -13.2%, and for the last 12 months is -11.8%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -11.64% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $420,249 which includes -$291 cash and excludes $13,252 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 47.5%, and for the last 12 months is 42.9%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -9.95% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $129 which includes $141,007 cash and excludes Gain to date spent on fees and slippage. |

|

|

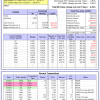

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 15.0%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.78% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $335,468 which includes -$1,458 cash and excludes $1,856 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 7.6%, and for the last 12 months is 22.8%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 10.14% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $77,462 which includes $1,396 cash and excludes $2,690 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -3.5%, and for the last 12 months is 6.4%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.15% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $203,486 which includes $4,785 cash and excludes $8,434 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -8.3%, and for the last 12 months is -4.2%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Since inception, on 7/1/2014, the model gained 218.55% while the benchmark SPY gained 210.64% and VDIGX gained 46.88% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -9.19% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $318,548 which includes $108 cash and excludes $5,432 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -14.8%, and for the last 12 months is -14.5%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -14.10% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $228,235 which includes $3,685 cash and excludes $4,005 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -3.2%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Since inception, on 6/30/2014, the model gained 230.92% while the benchmark SPY gained 210.64% and the ETF USMV gained 183.29% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -7.40% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $330,921 which includes $1,059 cash and excludes $8,559 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is -3.5%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Since inception, on 1/3/2013, the model gained 832.71% while the benchmark SPY gained 328.81% and the ETF USMV gained 328.81% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -8.54% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $932,705 which includes $136 cash and excludes $12,104 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 7.2%. Over the same period the benchmark BND performance was 2.4% and 5.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.36% at a time when BND gained -0.38%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $145,962 which includes $2,084 cash and excludes $2,730 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 15.0%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.78% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $335,468 which includes -$1,458 cash and excludes $1,856 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.6%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -6.46% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $173,553 which includes $125 cash and excludes $5,002 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -5.7%, and for the last 12 months is -1.1%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -7.78% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $162,152 which includes $909 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.37% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $207,450 which includes -$5,982 cash and excludes $7,366 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.2%, and for the last 12 months is 27.4%. Over the same period the benchmark SPY performance was -13.7% and -1.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.93% at a time when SPY gained -9.83%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $278,994 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.