|

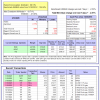

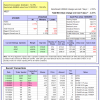

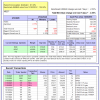

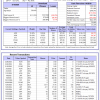

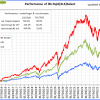

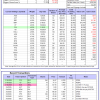

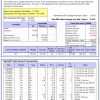

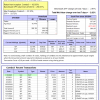

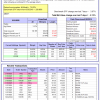

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is 7.9%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.20% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $133,368,826 which includes $1,921,515 cash and excludes $3,678,771 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -2.13% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $595,411 which includes $13,457 cash and excludes $763 spent on fees and slippage. |

|

|

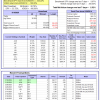

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -1.9%, and for the last 12 months is 4.0%. Over the same period the benchmark E60B40 performance was -1.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -2.87% at a time when SPY gained -2.53%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $168,127 which includes -$2,245 cash and excludes $4,552 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -2.6%, and for the last 12 months is 3.7%. Over the same period the benchmark E60B40 performance was -1.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -3.21% at a time when SPY gained -2.53%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $174,785 which includes -$2,946 cash and excludes $4,781 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 3.5%. Over the same period the benchmark E60B40 performance was -1.6% and 8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -3.55% at a time when SPY gained -2.53%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $181,336 which includes -$3,628 cash and excludes $5,001 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 614.53% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -6.55% at a time when SPY gained -3.97%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $177,644 which includes $5,548 cash and excludes $2,548 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 497.01% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -6.28% at a time when SPY gained -3.97%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $142,805 which includes -$6,724 cash and excludes $1,770 spent on fees and slippage. |

|

|

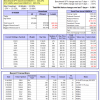

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 945.46% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.69% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,045,462 which includes $20,938 cash and excludes $17,282 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 182.22% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.63% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $282,217 which includes $1,603 cash and excludes $14,797 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 444.36% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.91% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $544,359 which includes $1,649 cash and excludes $7,379 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 725.10% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.11% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $825,101 which includes $1,143 cash and excludes $2,326 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 274.78% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -5.33% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $374,782 which includes $975 cash and excludes $2,345 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 414.51% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 3.01% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $514,505 which includes $535 cash and excludes $16,275 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 181.64% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -1.65% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,638 which includes -$1,118 cash and excludes $16,266 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 296.49% while the benchmark SPY gained 220.67% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -4.00% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $396,487 which includes $1,753 cash and excludes $6,695 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 79.26% while the benchmark SPY gained 66.46% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.29% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $179,259 which includes $1,197 cash and excludes $00 spent on fees and slippage. |

|

|

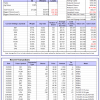

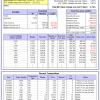

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 7.9%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.06% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $491,891 which includes $4,507 cash and excludes $12,931 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 32.8%, and for the last 12 months is 50.3%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 3.76% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $19 which includes $140,962 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.35% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $331,778 which includes $5,281 cash and excludes $1,748 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.94% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $68,907 which includes $516 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is 5.9%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.82% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $202,949 which includes $4,608 cash and excludes $8,278 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Since inception, on 7/1/2014, the model gained 253.90% while the benchmark SPY gained 244.22% and VDIGX gained -100.00% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.52% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $353,902 which includes $178 cash and excludes $5,411 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -0.9%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.76% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $265,463 which includes $2,746 cash and excludes $4,005 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 19.0%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Since inception, on 6/30/2014, the model gained 258.91% while the benchmark SPY gained 244.22% and the ETF USMV gained 205.03% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.38% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $358,906 which includes -$1,279 cash and excludes $8,531 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 3.0%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Since inception, on 1/3/2013, the model gained 895.44% while the benchmark SPY gained 375.17% and the ETF USMV gained 375.17% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.15% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $995,441 which includes $5,418 cash and excludes $11,803 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 4.5%. Over the same period the benchmark BND performance was 2.6% and 4.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.35% at a time when BND gained -0.37%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $144,961 which includes $1,626 cash and excludes $2,730 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is 14.9%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.35% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $331,778 which includes $5,281 cash and excludes $1,748 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.0%, and for the last 12 months is 17.2%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -1.17% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,374 which includes $120 cash and excludes $4,996 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.2%, and for the last 12 months is 6.6%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -2.13% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,618 which includes -$218 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -4.3%, and for the last 12 months is 1.4%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -3.95% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $205,965 which includes -$6,661 cash and excludes $7,366 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 9.9%, and for the last 12 months is 32.1%. Over the same period the benchmark SPY performance was -4.4% and 11.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.26% at a time when SPY gained -3.97%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $270,933 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.