|

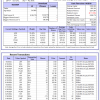

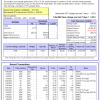

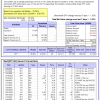

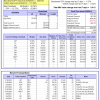

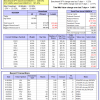

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -10.9%, and for the last 12 months is -13.3%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.59% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $118,161,185 which includes $1,086,016 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.69% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $600,386 which includes $7,730 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 10.6%, and for the last 12 months is 17.1%. Over the same period the benchmark E60B40 performance was 14.4% and 24.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.14% at a time when SPY gained 0.71%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $171,356 which includes $2,676 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is 18.1%. Over the same period the benchmark E60B40 performance was 14.4% and 24.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.14% at a time when SPY gained 0.71%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $178,548 which includes $2,708 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.1%, and for the last 12 months is 19.1%. Over the same period the benchmark E60B40 performance was 14.4% and 24.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.15% at a time when SPY gained 0.71%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $185,665 which includes $2,916 cash and excludes $4,268 spent on fees and slippage. |

|

|

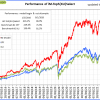

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 631.09% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.29% at a time when SPY gained 1.52%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $179,947 which includes $5,559 cash and excludes $2,442 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 500.78% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.73% at a time when SPY gained 1.52%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $150,196 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 966.33% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 2.22% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,066,326 which includes $1,247 cash and excludes $14,389 spent on fees and slippage. |

|

|

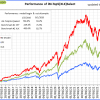

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 202.14% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.75% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $302,138 which includes $3,373 cash and excludes $14,322 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 415.50% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 1.15% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $515,499 which includes $2,507 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 702.95% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 1.28% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $802,953 which includes $6,324 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 265.81% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.53% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $365,812 which includes $333 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 419.32% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.47% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $519,320 which includes $1,168 cash and excludes $13,938 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 179.17% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.25% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $279,174 which includes $400 cash and excludes $14,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 308.49% while the benchmark SPY gained 224.78% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.84% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $408,490 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 80.62% while the benchmark SPY gained 68.59% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.04% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $180,619 which includes $785 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 12.4%, and for the last 12 months is 28.7%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.36% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $493,443 which includes $1,730 cash and excludes $12,133 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 31.2%, and for the last 12 months is 52.4%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 2.53% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $7,512 which includes $137,189 cash and excludes Gain to date spent on fees and slippage. |

|

|

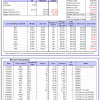

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.4%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.77% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,289 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 21.1%, and for the last 12 months is 12.6%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of Best(SPY-SH) gained 1.52% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $69,776 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 14.1%, and for the last 12 months is 20.0%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.71% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $208,367 which includes $3,024 cash and excludes $8,264 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 24.4%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Since inception, on 7/1/2014, the model gained 255.49% while the benchmark SPY gained 248.63% and VDIGX gained 177.86% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.01% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $355,494 which includes $518 cash and excludes $5,149 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 11.0%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 2.77% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $266,668 which includes $3,002 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 16.8%, and for the last 12 months is 19.9%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Since inception, on 6/30/2014, the model gained 238.73% while the benchmark SPY gained 248.63% and the ETF USMV gained 197.42% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.46% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $338,730 which includes $4,301 cash and excludes $8,260 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 17.9%, and for the last 12 months is 23.7%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Since inception, on 1/3/2013, the model gained 906.33% while the benchmark SPY gained 381.25% and the ETF USMV gained 381.25% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.12% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,006,325 which includes $3,610 cash and excludes $11,301 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 6.2%, and for the last 12 months is 11.5%. Over the same period the benchmark BND performance was 4.8% and 10.6% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.77% at a time when BND gained -0.52%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $145,796 which includes $2,584 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.4%, and for the last 12 months is 23.2%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.77% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,289 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 21.8%, and for the last 12 months is 26.0%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.28% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $183,925 which includes $511 cash and excludes $4,627 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 14.5%, and for the last 12 months is 24.1%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.22% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $185,576 which includes $259 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.77% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $212,699 which includes $3,487 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 27.0%, and for the last 12 months is 35.9%. Over the same period the benchmark SPY performance was 21.0% and 34.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.69% at a time when SPY gained 1.52%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $247,020 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.