|

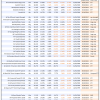

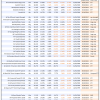

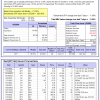

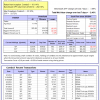

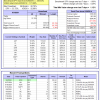

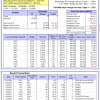

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

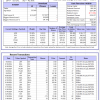

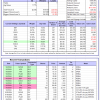

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -14.3%, and for the last 12 months is -21.3%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -1.26% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $113,691,191 which includes $856,605 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.25% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $591,943 which includes $6,701 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 14.0%. Over the same period the benchmark E60B40 performance was 11.6% and 17.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.14% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $168,933 which includes $2,676 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 14.9%. Over the same period the benchmark E60B40 performance was 11.6% and 17.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.14% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $176,021 which includes $2,708 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 15.9%. Over the same period the benchmark E60B40 performance was 11.6% and 17.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.14% at a time when SPY gained -1.00%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $183,040 which includes $2,916 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 602.61% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.17% at a time when SPY gained -1.69%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $172,827 which includes $5,501 cash and excludes $2,442 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 455.68% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -3.23% at a time when SPY gained -1.69%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $138,920 which includes $789 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 923.37% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.77% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,023,365 which includes $5,884 cash and excludes $13,438 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 194.62% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.71% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $294,621 which includes $1,818 cash and excludes $14,142 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 405.80% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.33% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $505,797 which includes $2,507 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 677.68% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -3.36% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $777,679 which includes $5,645 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 269.12% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.66% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $369,124 which includes $333 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 405.60% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.33% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $505,601 which includes $1,476 cash and excludes $13,648 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 172.14% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.47% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $272,138 which includes $1,625 cash and excludes $14,364 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 307.22% while the benchmark SPY gained 213.79% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.65% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $407,217 which includes $2,508 cash and excludes $6,690 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 76.60% while the benchmark SPY gained 62.89% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.33% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $176,601 which includes $1,002 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 7.9%, and for the last 12 months is 14.6%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.53% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $473,599 which includes $1,263 cash and excludes $12,133 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 25.3%, and for the last 12 months is 53.6%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.61% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$2,444 which includes $137,187 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 20.0%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.08% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $309,363 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 17.0%, and for the last 12 months is 14.2%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.69% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $67,417 which includes $63 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 10.3%, and for the last 12 months is 14.7%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.40% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $201,335 which includes $3,010 cash and excludes $8,253 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 16.8%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Since inception, on 7/1/2014, the model gained 248.15% while the benchmark SPY gained 236.83% and VDIGX gained 173.99% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.12% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $348,147 which includes $1,139 cash and excludes $5,084 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.30% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $261,270 which includes $2,098 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Since inception, on 6/30/2014, the model gained 234.36% while the benchmark SPY gained 236.83% and the ETF USMV gained 194.66% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 1.35% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $334,360 which includes $2,895 cash and excludes $8,260 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 18.0%, and for the last 12 months is 26.7%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Since inception, on 1/3/2013, the model gained 907.46% while the benchmark SPY gained 364.97% and the ETF USMV gained 364.97% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.70% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,007,455 which includes $3,112 cash and excludes $11,301 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 5.2%, and for the last 12 months is 8.7%. Over the same period the benchmark BND performance was 3.7% and 8.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.08% at a time when BND gained 0.01%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $144,428 which includes $2,584 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 15.3%, and for the last 12 months is 20.0%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.08% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $309,363 which includes $6,192 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 18.3%, and for the last 12 months is 17.6%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.14% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,575 which includes $511 cash and excludes $4,627 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 11.0%, and for the last 12 months is 15.7%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.27% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,001 which includes $259 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 11.7%, and for the last 12 months is 16.1%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.08% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $210,699 which includes $3,487 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 20.6%, and for the last 12 months is 28.0%. Over the same period the benchmark SPY performance was 16.9% and 24.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.31% at a time when SPY gained -1.69%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $234,466 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.