|

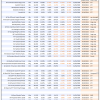

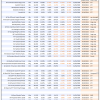

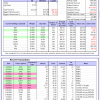

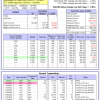

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

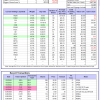

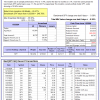

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -3.9%, and for the last 12 months is 2.3%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 1.27% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $127,479,158 which includes $2,263,654 cash and excludes $2,951,234 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.53% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $553,461 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 8.4%. Over the same period the benchmark E60B40 performance was 6.4% and 15.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.75% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $161,377 which includes $1,259 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.9%, and for the last 12 months is 9.2%. Over the same period the benchmark E60B40 performance was 6.4% and 15.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.75% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $168,142 which includes $1,231 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 5.6%, and for the last 12 months is 10.0%. Over the same period the benchmark E60B40 performance was 6.4% and 15.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.75% at a time when SPY gained 0.17%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $174,854 which includes $1,381 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 570.73% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -2.83% at a time when SPY gained -0.38%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $167,369 which includes $1,805 cash and excludes $2,352 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 428.56% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.89% at a time when SPY gained -0.38%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $125,691 which includes -$6,664 cash and excludes $1,560 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 956.34% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.39% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,056,341 which includes $1,715 cash and excludes $11,627 spent on fees and slippage. |

|

|

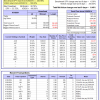

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 198.11% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 1.04% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $298,109 which includes $2,170 cash and excludes $13,278 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 382.46% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.66% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $482,463 which includes $3,851 cash and excludes $6,567 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 685.03% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.37% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $785,032 which includes $2,573 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 239.22% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.19% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $339,221 which includes $3,718 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 332.58% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.36% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $432,581 which includes $1,647 cash and excludes $13,225 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 144.71% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.50% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $244,712 which includes $2,141 cash and excludes $13,783 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 293.76% while the benchmark SPY gained 199.02% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 5.95% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $393,762 which includes $2,353 cash and excludes $6,504 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 69.37% while the benchmark SPY gained 55.22% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.71% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $169,373 which includes $1,828 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 19.4%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.11% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $463,010 which includes $1,989 cash and excludes $11,730 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 1.9%, and for the last 12 months is -15.5%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.20% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $7,628 which includes $129,707 cash and excludes Gain to date spent on fees and slippage. |

|

|

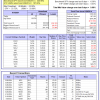

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.12% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,329 which includes $3,508 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is 5.1%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.38% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $64,240 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 6.3%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.64% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $194,152 which includes $2,622 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Since inception, on 7/1/2014, the model gained 222.37% while the benchmark SPY gained 220.98% and VDIGX gained -100.00% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -0.49% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $322,366 which includes $1,392 cash and excludes $4,868 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is 15.1%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.42% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $256,830 which includes $3,593 cash and excludes $3,348 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 9.5%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Since inception, on 6/30/2014, the model gained 201.46% while the benchmark SPY gained 220.98% and the ETF USMV gained 167.00% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.98% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $301,455 which includes $118 cash and excludes $8,180 spent on fees and slippage. |

|

|

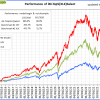

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 8.0%, and for the last 12 months is 27.3%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Since inception, on 1/3/2013, the model gained 821.75% while the benchmark SPY gained 343.09% and the ETF USMV gained 343.09% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.86% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $921,750 which includes $4,029 cash and excludes $11,008 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.3%, and for the last 12 months is 0.3%. Over the same period the benchmark BND performance was -0.9% and 2.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.13% at a time when BND gained 1.00%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,926 which includes $1,328 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 9.3%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 1.12% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $293,329 which includes $3,508 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is 9.9%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.65% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $162,671 which includes $364 cash and excludes $4,617 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 1.8%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.27% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,055 which includes $327 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.9%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.13% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $199,740 which includes $1,653 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.7%, and for the last 12 months is 20.1%. Over the same period the benchmark SPY performance was 11.4% and 25.1% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.42% at a time when SPY gained -0.38%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $221,093 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.