|

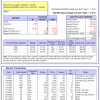

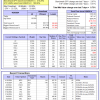

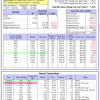

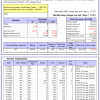

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

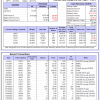

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -4.9%, and for the last 12 months is -4.5%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -1.12% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $126,163,543 which includes $1,826,494 cash and excludes $2,951,234 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.73% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $546,845 which includes $3,462 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 7.9%. Over the same period the benchmark E60B40 performance was 3.4% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.41% at a time when SPY gained 1.31%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $158,612 which includes $258 cash and excludes $3,876 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 3.1%, and for the last 12 months is 9.2%. Over the same period the benchmark E60B40 performance was 3.4% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.41% at a time when SPY gained 1.31%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $165,260 which includes $188 cash and excludes $4,076 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 10.5%. Over the same period the benchmark E60B40 performance was 3.4% and 13.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.41% at a time when SPY gained 1.31%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $171,858 which includes $296 cash and excludes $4,268 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 527.11% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.47% at a time when SPY gained 2.07%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $156,777 which includes $3,242 cash and excludes $2,289 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 390.12% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 5.42% at a time when SPY gained 2.07%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $122,529 which includes $124 cash and excludes $1,464 spent on fees and slippage. |

|

|

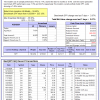

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 892.12% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 2.83% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $992,116 which includes $2,784 cash and excludes $11,552 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 190.68% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.26% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $290,684 which includes -$1,273 cash and excludes $12,888 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 387.32% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.49% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $487,315 which includes $1,696 cash and excludes $6,567 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 606.61% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 2.18% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $706,610 which includes $2,989 cash and excludes $2,149 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 215.41% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.42% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $315,414 which includes $3,464 cash and excludes $2,179 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 326.86% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 2.71% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $426,864 which includes $1,079 cash and excludes $12,662 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 138.63% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.23% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $238,629 which includes $2,523 cash and excludes $13,442 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 269.24% while the benchmark SPY gained 188.97% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.26% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $369,236 which includes -$371 cash and excludes $6,346 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 58.43% while the benchmark SPY gained 50.01% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.65% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $158,431 which includes $2,913 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 7.3%, and for the last 12 months is 23.0%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.67% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $471,185 which includes $2,863 cash and excludes $11,270 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 2.8%, and for the last 12 months is -21.3%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 12.81% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $02 which includes $129,703 cash and excludes Gain to date spent on fees and slippage. |

|

|

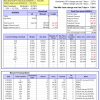

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.2%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.12% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,674 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 7.7%, and for the last 12 months is -0.6%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 2.07% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $62,076 which includes -$151 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 2.8%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 1.82% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $187,655 which includes $2,267 cash and excludes $8,234 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 13.3%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Since inception, on 7/1/2014, the model gained 226.73% while the benchmark SPY gained 210.20% and VDIGX gained 152.97% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.24% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $326,731 which includes $799 cash and excludes $4,868 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.67% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $266,901 which includes $2,413 cash and excludes $3,348 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 1.5%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Since inception, on 6/30/2014, the model gained 194.39% while the benchmark SPY gained 210.20% and the ETF USMV gained 162.80% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.73% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $294,393 which includes $722 cash and excludes $8,054 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.8%, and for the last 12 months is 26.8%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Since inception, on 1/3/2013, the model gained 803.37% while the benchmark SPY gained 328.20% and the ETF USMV gained 328.20% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.69% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $903,373 which includes $488 cash and excludes $10,476 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -2.2%, and for the last 12 months is -3.5%. Over the same period the benchmark BND performance was -2.7% and -1.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.12% at a time when BND gained 0.17%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $134,280 which includes $532 cash and excludes $2,613 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 7.2%, and for the last 12 months is 9.7%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.12% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $287,674 which includes $1,805 cash and excludes $1,547 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 6.8%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.83% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,036 which includes $158 cash and excludes $4,614 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -0.2%, and for the last 12 months is 4.1%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.78% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $161,824 which includes $574 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 3.8%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.12% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $195,875 which includes $489 cash and excludes $6,532 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 13.1%, and for the last 12 months is 17.0%. Over the same period the benchmark SPY performance was 7.6% and 24.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.28% at a time when SPY gained 2.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $219,991 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.