|

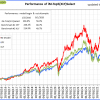

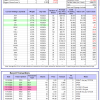

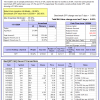

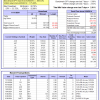

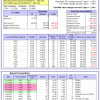

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is -2.8%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 5.41% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $125,189,527 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 4.15% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $620,195 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 19.5%. Over the same period the benchmark E60B40 performance was 16.7% and 25.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 3.47% at a time when SPY gained 3.10%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $174,571 which includes $772 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 14.2%, and for the last 12 months is 21.3%. Over the same period the benchmark E60B40 performance was 16.7% and 25.4% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 4.00% at a time when SPY gained 3.10%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $183,124 which includes $617 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 23.1%. Over the same period the benchmark E60B40 performance was 16.7% and 25.4% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 4.54% at a time when SPY gained 3.10%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $191,705 which includes $734 cash and excludes $4,632 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 688.77% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 7.31% at a time when SPY gained 5.08%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $194,369 which includes $4,344 cash and excludes $2,450 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 562.38% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 8.49% at a time when SPY gained 5.08%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $165,596 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 996.89% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 3.13% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,096,894 which includes $3,649 cash and excludes $15,754 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 218.95% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 4.19% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $318,947 which includes $515 cash and excludes $14,346 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 477.99% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 7.65% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $577,991 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 760.29% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 5.31% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $860,293 which includes $331 cash and excludes $2,271 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 258.21% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.07% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $358,214 which includes $1,934 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 400.28% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.84% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $500,284 which includes -$3,585 cash and excludes $14,667 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 181.73% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 1.72% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,725 which includes $1,042 cash and excludes $15,159 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 304.17% while the benchmark SPY gained 241.36% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.57% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $404,166 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 86.67% while the benchmark SPY gained 77.20% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 2.93% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $186,673 which includes $714 cash and excludes $00 spent on fees and slippage. |

|

|

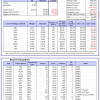

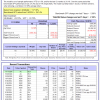

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 13.5%, and for the last 12 months is 34.3%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 3.40% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $498,244 which includes $1,439 cash and excludes $12,497 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 1.6%, and for the last 12 months is 24.1%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -7.32% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $2,796 which includes $140,952 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 20.2%, and for the last 12 months is 28.2%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 5.06% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $322,382 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 27.2%, and for the last 12 months is 20.0%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 5.06% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $73,325 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 17.1%, and for the last 12 months is 20.2%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained 3.46% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $213,730 which includes $5,535 cash and excludes $8,272 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 12.9%, and for the last 12 months is 23.9%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Since inception, on 7/1/2014, the model gained 253.53% while the benchmark SPY gained 266.43% and VDIGX gained 175.66% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 2.61% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $353,534 which includes $736 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 16.5%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.43% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $277,825 which includes $1,033 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 22.2%, and for the last 12 months is 25.6%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Since inception, on 6/30/2014, the model gained 254.52% while the benchmark SPY gained 266.43% and the ETF USMV gained 204.23% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.34% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $354,523 which includes $13 cash and excludes $8,350 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 20.9%, and for the last 12 months is 30.1%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Since inception, on 1/3/2013, the model gained 932.32% while the benchmark SPY gained 405.83% and the ETF USMV gained 405.83% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 4.41% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,032,324 which includes $3,140 cash and excludes $11,758 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 10.0%. Over the same period the benchmark BND performance was 2.2% and 8.5% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 1.14% at a time when BND gained 0.17%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $142,653 which includes $720 cash and excludes $2,671 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 20.2%, and for the last 12 months is 28.2%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 5.06% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $322,382 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 20.6%, and for the last 12 months is 27.4%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.99% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,027 which includes $462 cash and excludes $4,987 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 11.8%, and for the last 12 months is 23.0%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 1.12% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $181,248 which includes -$311 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 16.2%, and for the last 12 months is 23.8%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 5.05% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $219,179 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 26.8%, and for the last 12 months is 35.0%. Over the same period the benchmark SPY performance was 27.2% and 37.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.23% at a time when SPY gained 5.08%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $246,521 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.