|

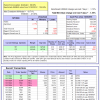

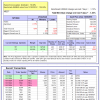

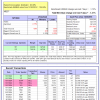

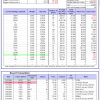

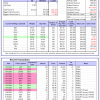

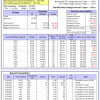

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

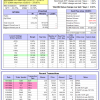

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -10.7%, and for the last 12 months is -11.1%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -1.03% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $118,444,787 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.88% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $598,654 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 9.1%, and for the last 12 months is 17.8%. Over the same period the benchmark E60B40 performance was 13.5% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.39% at a time when SPY gained -1.13%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $168,937 which includes $717 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 9.8%, and for the last 12 months is 18.8%. Over the same period the benchmark E60B40 performance was 13.5% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.40% at a time when SPY gained -1.13%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $176,004 which includes $574 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 19.8%. Over the same period the benchmark E60B40 performance was 13.5% and 24.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.41% at a time when SPY gained -1.13%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $182,998 which includes $704 cash and excludes $4,632 spent on fees and slippage. |

|

|

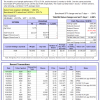

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 620.54% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.62% at a time when SPY gained -1.04%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $177,310 which includes $6,624 cash and excludes $2,447 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 502.99% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.72% at a time when SPY gained -1.04%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $150,748 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 989.37% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.49% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,089,372 which includes $2,949 cash and excludes $14,835 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 213.59% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.42% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $313,585 which includes $495 cash and excludes $14,326 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 424.81% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.52% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $524,811 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 702.93% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -0.47% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $802,930 which includes $8,303 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 257.96% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -3.88% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $357,962 which includes $1,186 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 424.06% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.58% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $524,065 which includes $2,536 cash and excludes $13,938 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 175.05% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.21% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $275,055 which includes $885 cash and excludes $14,620 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 306.24% while the benchmark SPY gained 223.71% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -3.74% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $406,238 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

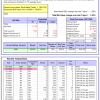

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 79.93% while the benchmark SPY gained 68.04% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.76% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $179,931 which includes $1,625 cash and excludes $00 spent on fees and slippage. |

|

|

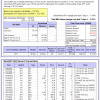

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 11.9%, and for the last 12 months is 28.7%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.98% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $491,419 which includes $2,109 cash and excludes $12,278 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 27.6%, and for the last 12 months is 40.8%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -0.88% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $25 which includes $137,198 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.85% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $305,787 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 20.7%, and for the last 12 months is 11.7%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of Best(SPY-SH) gained -1.03% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $69,548 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 13.6%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.19% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $207,375 which includes $3,211 cash and excludes $8,264 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 25.2%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Since inception, on 7/1/2014, the model gained 251.39% while the benchmark SPY gained 247.49% and VDIGX gained 172.46% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.13% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $351,394 which includes $89 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 5.3%, and for the last 12 months is 13.2%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.76% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $269,795 which includes $3,002 cash and excludes $3,570 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 19.1%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Since inception, on 6/30/2014, the model gained 238.20% while the benchmark SPY gained 247.49% and the ETF USMV gained 193.70% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.61% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $338,197 which includes $1,694 cash and excludes $8,317 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 19.6%, and for the last 12 months is 29.4%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Since inception, on 1/3/2013, the model gained 921.13% while the benchmark SPY gained 379.67% and the ETF USMV gained 379.67% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.91% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,021,128 which includes $3,140 cash and excludes $11,758 spent on fees and slippage. |

|

|

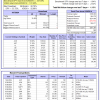

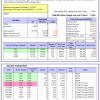

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 11.7%. Over the same period the benchmark BND performance was 3.3% and 11.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.82% at a time when BND gained -1.28%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $142,805 which includes $66 cash and excludes $2,671 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 14.0%, and for the last 12 months is 23.4%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -1.85% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $305,787 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 18.5%, and for the last 12 months is 26.6%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -2.58% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,962 which includes $462 cash and excludes $4,987 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.2%, and for the last 12 months is 24.5%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.99% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $181,974 which includes -$697 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 10.2%, and for the last 12 months is 19.2%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -2.02% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $207,910 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 27.8%, and for the last 12 months is 44.0%. Over the same period the benchmark SPY performance was 20.6% and 34.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.45% at a time when SPY gained -1.04%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $248,575 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.