|

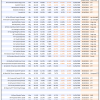

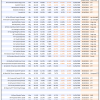

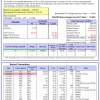

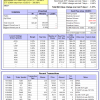

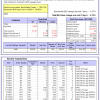

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -8.5%, and for the last 12 months is -12.9%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -0.63% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $121,346,514 which includes $1,178,800 cash and excludes $3,555,973 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained -0.90% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $604,159 which includes $9,955 cash and excludes $763 spent on fees and slippage. |

|

|

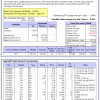

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 10.1%, and for the last 12 months is 19.2%. Over the same period the benchmark E60B40 performance was 14.5% and 29.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.45% at a time when SPY gained -0.43%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $170,532 which includes $717 cash and excludes $4,212 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 11.2%, and for the last 12 months is 20.6%. Over the same period the benchmark E60B40 performance was 14.5% and 29.3% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.45% at a time when SPY gained -0.43%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $178,271 which includes $574 cash and excludes $4,426 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 12.3%, and for the last 12 months is 22.0%. Over the same period the benchmark E60B40 performance was 14.5% and 29.3% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.45% at a time when SPY gained -0.43%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $185,988 which includes $704 cash and excludes $4,632 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 637.25% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -2.35% at a time when SPY gained -0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $181,488 which includes $4,324 cash and excludes $2,450 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 526.15% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 1.03% at a time when SPY gained -0.48%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $156,538 which includes $915 cash and excludes $1,611 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 979.21% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.11% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $1,079,214 which includes $2,118 cash and excludes $15,312 spent on fees and slippage. |

|

|

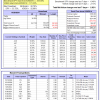

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 207.30% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.08% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $307,301 which includes $192 cash and excludes $14,346 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 438.41% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -3.47% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $538,412 which includes $3,101 cash and excludes $6,633 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 715.45% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -1.00% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $815,453 which includes $8,303 cash and excludes $2,212 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 260.55% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.65% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $360,550 which includes $1,667 cash and excludes $2,276 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 404.61% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.69% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $504,608 which includes $9,637 cash and excludes $14,195 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 181.54% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.61% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $281,545 which includes $332 cash and excludes $14,917 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 301.80% while the benchmark SPY gained 231.14% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.23% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $401,801 which includes $1,088 cash and excludes $6,693 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 81.68% while the benchmark SPY gained 71.90% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.52% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $181,675 which includes $2,396 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 11.6%, and for the last 12 months is 35.9%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -2.10% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $489,935 which includes $2,109 cash and excludes $12,278 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 15.8%, and for the last 12 months is 24.1%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -16.50% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $33,200 which includes $140,907 cash and excludes Gain to date spent on fees and slippage. |

|

|

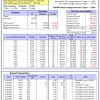

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 26.2%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.48% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,771 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is 23.4%, and for the last 12 months is 8.9%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.48% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $71,138 which includes $276 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is 15.1%, and for the last 12 months is 20.5%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.59% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $210,083 which includes $2,344 cash and excludes $8,269 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 11.5%, and for the last 12 months is 29.3%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Since inception, on 7/1/2014, the model gained 249.26% while the benchmark SPY gained 255.46% and VDIGX gained 173.33% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.82% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $349,257 which includes $660 cash and excludes $5,224 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.5%, and for the last 12 months is 13.0%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.51% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $267,813 which includes $1,033 cash and excludes $3,789 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 17.9%, and for the last 12 months is 25.4%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Since inception, on 6/30/2014, the model gained 241.78% while the benchmark SPY gained 255.46% and the ETF USMV gained 197.09% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.68% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $341,783 which includes $1,694 cash and excludes $8,317 spent on fees and slippage. |

|

|

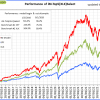

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 17.4%, and for the last 12 months is 29.9%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Since inception, on 1/3/2013, the model gained 902.12% while the benchmark SPY gained 390.68% and the ETF USMV gained 390.68% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.27% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $1,002,121 which includes $3,140 cash and excludes $11,758 spent on fees and slippage. |

|

|

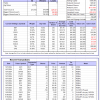

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.2%, and for the last 12 months is 10.8%. Over the same period the benchmark BND performance was 2.1% and 10.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.10% at a time when BND gained -0.37%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $141,658 which includes $66 cash and excludes $2,671 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 16.6%, and for the last 12 months is 26.2%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.48% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $312,771 which includes $1,447 cash and excludes $1,645 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 19.6%, and for the last 12 months is 31.7%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.91% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,600 which includes $462 cash and excludes $4,987 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 12.8%, and for the last 12 months is 27.6%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.13% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $182,825 which includes $37 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 12.7%, and for the last 12 months is 21.9%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.48% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $212,653 which includes $1,230 cash and excludes $6,946 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 32.6%, and for the last 12 months is 36.2%. Over the same period the benchmark SPY performance was 23.4% and 43.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.81% at a time when SPY gained -0.48%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $257,867 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.