|

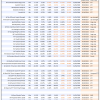

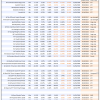

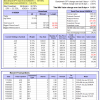

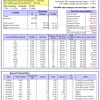

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

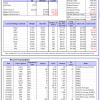

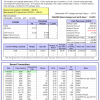

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -3.3%, and for the last 12 months is -11.0%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -2.69% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $128,228,022 which includes $1,776,912 cash and excludes $2,691,375 spent on fees and slippage. |

|

|

iM-Conference Board LEIg Timer: The model’s performance YTD is 14.3%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was 20.1% and 9.4% respectively. Over the previous week the market value of the iM-Conference Board LEIg Timer gained 0.02% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 4/5/2017 would have grown to $523,937 which includes $44 cash and excludes $566 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 6.8%. Over the same period the benchmark E60B40 performance was -0.4% and 13.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.05% at a time when SPY gained -0.03%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $154,286 which includes $515 cash and excludes $3,553 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -0.4%, and for the last 12 months is 7.5%. Over the same period the benchmark E60B40 performance was -0.4% and 13.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.08% at a time when SPY gained -0.03%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $159,639 which includes $478 cash and excludes $3,740 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -0.5%, and for the last 12 months is 8.2%. Over the same period the benchmark E60B40 performance was -0.4% and 13.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.12% at a time when SPY gained -0.03%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $164,871 which includes $448 cash and excludes $3,918 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 467.38% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 1.39% at a time when SPY gained 0.07%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $141,845 which includes $6,887 cash and excludes $2,210 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 337.74% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 0.38% at a time when SPY gained 0.07%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $109,435 which includes $180 cash and excludes $1,356 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 759.61% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 0.84% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $859,610 which includes $270 cash and excludes $11,074 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 192.52% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -2.50% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $292,518 which includes $563 cash and excludes $12,081 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 368.05% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.98% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $468,052 which includes $6,808 cash and excludes $6,515 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 569.30% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.86% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $669,298 which includes $3,519 cash and excludes $2,085 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 195.40% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -1.18% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,398 which includes $627 cash and excludes $2,046 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 305.13% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.01% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $405,131 which includes -$5,882 cash and excludes $12,093 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 121.10% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -3.97% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $221,102 which includes $478 cash and excludes $13,032 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 260.33% while the benchmark SPY gained 168.23% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.59% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $360,329 which includes $910 cash and excludes $6,155 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 51.91% while the benchmark SPY gained 39.24% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -0.72% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $151,908 which includes $3,245 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is 8.1%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -3.15% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $424,144 which includes $2,419 cash and excludes $10,883 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -13.0%, and for the last 12 months is -23.1%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -10.49% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$1,385 which includes $129,688 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.07% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,093 which includes $233 cash and excludes $1,452 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.07% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $57,596 which includes -$346 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -0.3%, and for the last 12 months is -0.7%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of iM-Combo3.R1 gained 0.67% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $182,026 which includes $2,005 cash and excludes $8,225 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 7.5%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Since inception, on 7/1/2014, the model gained 214.59% while the benchmark SPY gained 187.94% and VDIGX gained 148.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.12% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $314,585 which includes $458 cash and excludes $4,771 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -0.7%, and for the last 12 months is 8.7%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -1.88% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $254,398 which includes $3,661 cash and excludes $3,100 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is 8.3%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Since inception, on 6/30/2014, the model gained 195.68% while the benchmark SPY gained 187.94% and the ETF USMV gained 152.97% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.20% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $295,681 which includes $4,075 cash and excludes $7,989 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 0.4%, and for the last 12 months is 18.0%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Since inception, on 1/3/2013, the model gained 756.85% while the benchmark SPY gained 297.47% and the ETF USMV gained 297.47% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.05% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $856,847 which includes -$6,420 cash and excludes $9,009 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -0.2%, and for the last 12 months is -0.3%. Over the same period the benchmark BND performance was -0.8% and 1.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.13% at a time when BND gained -0.18%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $136,957 which includes $759 cash and excludes $2,553 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 2.9%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.07% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,093 which includes $233 cash and excludes $1,452 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 0.6%, and for the last 12 months is 3.4%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.02% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,888 which includes -$52 cash and excludes $4,295 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -1.2%, and for the last 12 months is 3.8%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.26% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $160,169 which includes $256 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 7.3%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.07% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $188,475 which includes $403 cash and excludes $6,127 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.7%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was -0.1% and 21.0% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.04% at a time when SPY gained 0.07%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $191,239 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.