|

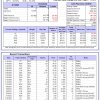

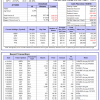

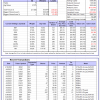

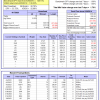

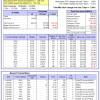

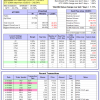

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -13.1%, and for the last 12 months is -15.5%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained -0.55% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $134,372,171 which includes $526,225 cash and excludes $2,179,079 spent on fees and slippage. |

|

|

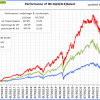

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is -2.6%. Over the same period the benchmark E60B40 performance was 6.4% and -2.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.28% at a time when SPY gained 0.28%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $146,441 which includes $1,093 cash and excludes $2,960 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is -2.4%. Over the same period the benchmark E60B40 performance was 6.4% and -2.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.48% at a time when SPY gained 0.28%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,845 which includes $1,225 cash and excludes $3,126 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is -2.2%. Over the same period the benchmark E60B40 performance was 6.4% and -2.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.68% at a time when SPY gained 0.28%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,095 which includes $1,461 cash and excludes $3,285 spent on fees and slippage. |

|

|

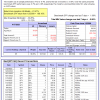

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 310.24% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.74% at a time when SPY gained 1.06%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $102,561 which includes -$3,782 cash and excludes $1,908 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 213.76% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.44% at a time when SPY gained 1.06%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $78,441 which includes $346 cash and excludes $1,242 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 501.19% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -2.71% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $601,187 which includes $1,908 cash and excludes $9,482 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 173.09% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 3.15% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $273,087 which includes $396 cash and excludes $9,965 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 307.70% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 2.24% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $407,702 which includes $625 cash and excludes $5,584 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 428.74% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.97% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $528,740 which includes $2,828 cash and excludes $1,749 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 162.28% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.59% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $262,275 which includes $2,106 cash and excludes $1,744 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 398.35% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.69% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $498,352 which includes -$5,422 cash and excludes $9,576 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 133.55% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.70% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $233,549 which includes $1,040 cash and excludes $11,532 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 196.80% while the benchmark SPY gained 131.17% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -0.09% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $296,798 which includes $1,256 cash and excludes $5,392 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.02% while the benchmark SPY gained 20.00% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.50% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,023 which includes $294 cash and excludes $00 spent on fees and slippage. |

|

|

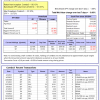

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 8.8%, and for the last 12 months is -0.7%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 1.25% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $395,124 which includes $2,409 cash and excludes $9,721 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 39.9%, and for the last 12 months is -19.7%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 1.30% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $11,032 which includes $120,799 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.98% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $260,908 which includes -$1,944 cash and excludes $1,281 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -6.4%, and for the last 12 months is -21.9%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.86% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $62,651 which includes $720 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -3.2%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.96% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $180,131 which includes $3,685 cash and excludes $8,067 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 2.0%, and for the last 12 months is -17.5%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of iM-Combo5 gained -1.07% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $156,429 which includes $869 cash and excludes $0 spent on fees and slippage. |

|

|

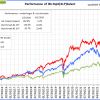

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.2%, and for the last 12 months is -1.2%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Since inception, on 7/1/2014, the model gained 189.73% while the benchmark SPY gained 148.15% and VDIGX gained 139.23% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.70% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $289,731 which includes $357 cash and excludes $4,474 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 9.0%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.23% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $235,692 which includes $3,211 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.1%, and for the last 12 months is 0.2%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Since inception, on 6/30/2014, the model gained 174.62% while the benchmark SPY gained 148.15% and the ETF USMV gained 134.73% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.59% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $274,616 which includes $1,503 cash and excludes $7,751 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 3.3%, and for the last 12 months is 15.4%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Since inception, on 1/3/2013, the model gained 623.53% while the benchmark SPY gained 242.54% and the ETF USMV gained 242.54% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.11% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $723,531 which includes $590 cash and excludes $7,981 spent on fees and slippage. |

|

|

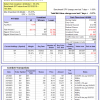

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 3.2%, and for the last 12 months is -3.9%. Over the same period the benchmark BND performance was 2.7% and -2.4% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.19% at a time when BND gained -0.89%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $137,221 which includes $1,679 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 3.4%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.98% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $260,908 which includes -$1,944 cash and excludes $1,281 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 5.5%, and for the last 12 months is -5.1%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.56% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $147,292 which includes -$541 cash and excludes $3,114 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 2.9%, and for the last 12 months is -7.4%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.07% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,341 which includes $811 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 1.04% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $180,897 which includes $2,075 cash and excludes $5,393 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 9.4%, and for the last 12 months is -0.4%. Over the same period the benchmark SPY performance was 8.7% and -3.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 0.23% at a time when SPY gained 1.06%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $188,708 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.