|

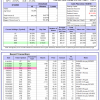

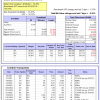

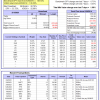

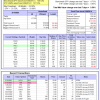

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

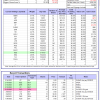

iM-Inflation Attuned Multi-Model Market Timer: The model’s out of sample performance YTD is -5.9%, and for the last 12 months is 6.2%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Inflation Attuned Multi-Model Market Timer gained 2.72% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 3/24/2017 would have grown to $145,643,533 which includes -$693,391 cash and excludes $2,179,079 spent on fees and slippage. |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is 3.5%, and for the last 12 months is -4.4%. Over the same period the benchmark E60B40 performance was 5.5% and -5.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.37% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $145,915 which includes $691 cash and excludes $2,960 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is -4.1%. Over the same period the benchmark E60B40 performance was 5.5% and -5.6% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 0.42% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $150,579 which includes $772 cash and excludes $3,126 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is 4.2%, and for the last 12 months is -3.8%. Over the same period the benchmark E60B40 performance was 5.5% and -5.6% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 0.47% at a time when SPY gained 0.24%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,104 which includes $956 cash and excludes $3,285 spent on fees and slippage. |

|

|

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 315.25% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 0.05% at a time when SPY gained 0.73%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $103,812 which includes $3,061 cash and excludes $1,836 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 198.98% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -0.42% at a time when SPY gained 0.73%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $74,745 which includes $1,115 cash and excludes $1,187 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 528.58% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.43% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $628,575 which includes $3,883 cash and excludes $9,478 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 187.66% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.24% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $287,657 which includes $175 cash and excludes $9,669 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 315.62% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.46% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $415,622 which includes $1,303 cash and excludes $5,411 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 438.95% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 0.26% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $538,951 which includes $219 cash and excludes $1,749 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 188.62% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 0.45% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $288,622 which includes $1,784 cash and excludes $1,729 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 413.64% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.36% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $513,639 which includes $9,678 cash and excludes $9,113 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 127.11% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.83% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $227,107 which includes $338 cash and excludes $11,122 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 217.69% while the benchmark SPY gained 129.67% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 0.26% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $317,686 which includes $1,743 cash and excludes $5,274 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 32.13% while the benchmark SPY gained 19.22% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.34% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $132,126 which includes $1,833 cash and excludes $00 spent on fees and slippage. |

|

|

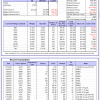

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is 11.4%, and for the last 12 months is 2.6%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -0.93% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $404,456 which includes $639 cash and excludes $9,330 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 1.6%, and for the last 12 months is -25.2%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -1.89% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $07 which includes $120,794 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is -9.9%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.57% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,455 which includes $2,108 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -6.8%, and for the last 12 months is -22.1%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.53% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $62,351 which includes $213 cash and excludes $2,437 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -4.1%, and for the last 12 months is -7.0%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.54% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $178,555 which includes $2,570 cash and excludes $8,061 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is 0.7%, and for the last 12 months is -23.2%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of iM-Combo5 gained -0.35% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $154,401 which includes $920 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is -2.4%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Since inception, on 7/1/2014, the model gained 188.93% while the benchmark SPY gained 146.54% and VDIGX gained 136.56% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 1.08% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $288,933 which includes $537 cash and excludes $4,462 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 7.9%, and for the last 12 months is 6.0%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 1.21% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $233,319 which includes $854 cash and excludes $2,675 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 2.4%, and for the last 12 months is 5.1%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Since inception, on 6/30/2014, the model gained 175.36% while the benchmark SPY gained 146.54% and the ETF USMV gained 131.53% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.56% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $275,362 which includes $54 cash and excludes $7,737 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 26.7%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Since inception, on 1/3/2013, the model gained 639.14% while the benchmark SPY gained 240.33% and the ETF USMV gained 240.33% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 0.61% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $739,137 which includes $1,796 cash and excludes $7,146 spent on fees and slippage. |

|

|

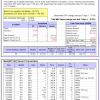

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is 1.7%, and for the last 12 months is -8.0%. Over the same period the benchmark BND performance was 2.0% and -8.3% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -0.57% at a time when BND gained -0.52%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $135,163 which includes $1,138 cash and excludes $2,495 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is -9.9%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.57% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $256,455 which includes $2,108 cash and excludes $1,196 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is 7.2%, and for the last 12 months is 1.3%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 0.54% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $149,636 which includes -$1,287 cash and excludes $2,537 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is 3.2%, and for the last 12 months is -2.7%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.46% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $154,759 which includes -$573 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is 5.7%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.73% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $179,767 which includes $1,424 cash and excludes $5,393 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 1.7%, and for the last 12 months is -1.9%. Over the same period the benchmark SPY performance was 7.9% and -4.8% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.77% at a time when SPY gained 0.73%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,395 which includes $36 cash and excludes $9,190 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.