|

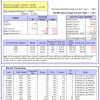

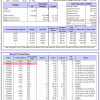

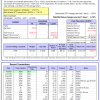

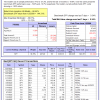

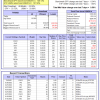

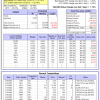

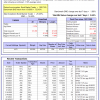

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -10.9%, and for the last 12 months is -5.2%. Over the same period the benchmark E60B40 performance was -15.0% and -9.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.25% at a time when SPY gained 1.00%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $145,111 which includes $2,951 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -11.3%, and for the last 12 months is -5.3%. Over the same period the benchmark E60B40 performance was -15.0% and -9.8% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.25% at a time when SPY gained 1.00%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $149,182 which includes $3,137 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -11.7%, and for the last 12 months is -5.4%. Over the same period the benchmark E60B40 performance was -15.0% and -9.8% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.25% at a time when SPY gained 1.00%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $153,077 which includes $3,259 cash and excludes $2,374 spent on fees and slippage. |

|

|

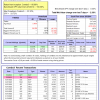

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 308.75% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.37% at a time when SPY gained 0.34%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $102,187 which includes -$1,068 cash and excludes $1,737 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 184.97% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.62% at a time when SPY gained 0.34%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $71,243 which includes $1 cash and excludes $1,112 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 388.83% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -6.23% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $488,829 which includes -$4,020 cash and excludes $9,109 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 136.37% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -4.51% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $236,367 which includes $738 cash and excludes $8,408 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 243.31% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.52% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $343,309 which includes $4,315 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 375.91% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -2.76% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $475,914 which includes $1,199 cash and excludes $1,738 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 189.41% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 1.81% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $289,409 which includes $2,307 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 357.21% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 1.15% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $457,206 which includes $4,063 cash and excludes $7,220 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 116.98% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -0.45% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $217,301 which includes $4,953 cash and excludes $9,666 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 140.01% while the benchmark SPY gained 110.66% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 2.32% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $240,007 which includes $573 cash and excludes $4,644 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 14.20% while the benchmark SPY gained 9.35% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -1.80% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $114,244 which includes $1,783 cash and excludes $00 spent on fees and slippage. |

|

|

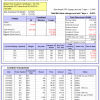

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -16.6%, and for the last 12 months is -17.4%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.44% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $335,848 which includes $870 cash and excludes $8,218 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -10.6%, and for the last 12 months is -7.1%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -5.16% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to -$1,676 which includes $104,276 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -17.4%, and for the last 12 months is -17.6%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.34% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $242,777 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -27.2%, and for the last 12 months is -19.9%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.34% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $64,577 which includes $790 cash and excludes $2,304 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -19.7%, and for the last 12 months is -10.9%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.38% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $168,979 which includes $1,822 cash and excludes $7,954 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -30.9%, and for the last 12 months is -24.6%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of iM-Combo5 gained -0.85% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $156,919 which includes $1,391 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -16.2%, and for the last 12 months is -11.0%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Since inception, on 7/1/2014, the model gained 168.37% while the benchmark SPY gained 126.13% and VDIGX gained 126.15% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.92% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $268,374 which includes $399 cash and excludes $4,356 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -3.8%, and for the last 12 months is -3.1%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.07% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $209,123 which includes $3,846 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -5.5%, and for the last 12 months is -2.5%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Since inception, on 6/30/2014, the model gained 147.98% while the benchmark SPY gained 126.13% and the ETF USMV gained 121.56% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.59% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $247,980 which includes $1,279 cash and excludes $7,530 spent on fees and slippage. |

|

|

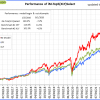

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 4.6%, and for the last 12 months is 9.2%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Since inception, on 1/3/2013, the model gained 501.17% while the benchmark SPY gained 212.16% and the ETF USMV gained 212.16% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 1.12% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $601,171 which includes $2,523 cash and excludes $6,594 spent on fees and slippage. |

|

|

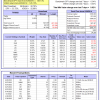

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -12.8%, and for the last 12 months is -13.4%. Over the same period the benchmark BND performance was -9.5% and -9.7% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.65% at a time when BND gained 1.99%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $132,406 which includes $551 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -17.4%, and for the last 12 months is -17.6%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.34% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $242,777 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -8.1%, and for the last 12 months is 1.3%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 1.26% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,025 which includes $1,074 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -10.2%, and for the last 12 months is -0.3%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 0.72% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,282 which includes $1,466 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -11.2%, and for the last 12 months is -2.2%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 3.01% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,747 which includes $2,178 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -5.1%, and for the last 12 months is 0.2%. Over the same period the benchmark SPY performance was -19.0% and -10.7% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -2.85% at a time when SPY gained 0.34%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $169,499 which includes -$5 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.