|

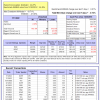

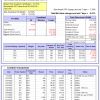

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

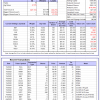

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -11.4%, and for the last 12 months is -6.0%. Over the same period the benchmark E60B40 performance was -15.0% and -10.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.72% at a time when SPY gained 0.21%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,778 which includes $2,463 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -11.8%, and for the last 12 months is -6.0%. Over the same period the benchmark E60B40 performance was -15.0% and -10.2% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.72% at a time when SPY gained 0.21%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $147,812 which includes $2,634 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -12.2%, and for the last 12 months is -6.1%. Over the same period the benchmark E60B40 performance was -15.0% and -10.2% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.72% at a time when SPY gained 0.21%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $151,672 which includes $2,744 cash and excludes $2,374 spent on fees and slippage. |

|

|

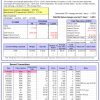

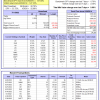

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 308.54% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.60% at a time when SPY gained 0.78%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $102,135 which includes -$1,052 cash and excludes $1,737 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 186.82% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 3.01% at a time when SPY gained 0.78%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $71,706 which includes $117 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 406.29% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 3.68% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $506,288 which includes -$4,020 cash and excludes $9,109 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 139.56% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -0.70% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $239,558 which includes $738 cash and excludes $8,408 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 243.32% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -0.66% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $343,315 which includes $4,315 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 388.34% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 2.68% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $488,338 which includes $1,985 cash and excludes $1,738 spent on fees and slippage. |

|

|

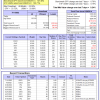

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 182.67% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -2.33% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $282,674 which includes $2,734 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 360.76% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.49% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $460,762 which includes $4,063 cash and excludes $7,220 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 119.68% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -2.18% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $219,680 which includes $4,953 cash and excludes $9,666 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 141.38% while the benchmark SPY gained 111.91% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 3.22% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $241,377 which includes $573 cash and excludes $4,644 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 15.57% while the benchmark SPY gained 10.00% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 0.40% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $115,575 which includes $1,873 cash and excludes $00 spent on fees and slippage. |

|

|

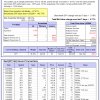

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -14.9%, and for the last 12 months is -15.7%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.28% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $342,745 which includes $870 cash and excludes $8,218 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -12.0%, and for the last 12 months is -8.4%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -3.90% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $31 which includes $104,278 cash and excludes Gain to date spent on fees and slippage. |

|

|

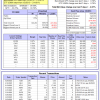

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -17.0%, and for the last 12 months is -17.6%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.79% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $244,223 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -26.8%, and for the last 12 months is -19.7%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of Best(SPY-SH) gained 0.77% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $64,956 which includes $790 cash and excludes $2,304 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -19.1%, and for the last 12 months is -10.7%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.14% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $170,405 which includes -$356 cash and excludes $7,956 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -30.7%, and for the last 12 months is -24.8%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of iM-Combo5 gained -0.23% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $157,436 which includes $1,343 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -15.3%, and for the last 12 months is -10.5%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Since inception, on 7/1/2014, the model gained 171.29% while the benchmark SPY gained 127.48% and VDIGX gained 127.35% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 0.69% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $271,288 which includes $399 cash and excludes $4,356 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -3.4%, and for the last 12 months is -3.0%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 0.79% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $209,025 which includes $2,920 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -5.5%, and for the last 12 months is -2.9%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Since inception, on 6/30/2014, the model gained 147.85% while the benchmark SPY gained 127.48% and the ETF USMV gained 122.71% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 0.24% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $247,852 which includes $1,366 cash and excludes $7,530 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 4.1%, and for the last 12 months is 7.7%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Since inception, on 1/3/2013, the model gained 497.89% while the benchmark SPY gained 214.01% and the ETF USMV gained 214.01% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.27% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $597,895 which includes $2,523 cash and excludes $6,594 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -12.2%, and for the last 12 months is -12.9%. Over the same period the benchmark BND performance was -10.2% and -10.8% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.66% at a time when BND gained -0.67%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $132,818 which includes -$37 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -17.0%, and for the last 12 months is -17.6%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.79% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $244,223 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is 1.1%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.20% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,436 which includes $1,074 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -10.4%, and for the last 12 months is -1.3%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -1.49% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $150,793 which includes $1,307 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.3%, and for the last 12 months is -3.8%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.91% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,216 which includes $1,914 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -7.0%, and for the last 12 months is -3.0%. Over the same period the benchmark SPY performance was -18.5% and -10.5% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -4.12% at a time when SPY gained 0.78%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $166,025 which includes $93 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.