|

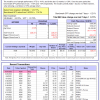

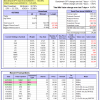

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -11.6%, and for the last 12 months is -5.0%. Over the same period the benchmark E60B40 performance was -14.8% and -8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.13% at a time when SPY gained 3.78%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $143,948 which includes $2,463 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is -5.0%. Over the same period the benchmark E60B40 performance was -14.8% and -8.5% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.13% at a time when SPY gained 3.78%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $147,986 which includes $2,634 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -12.4%, and for the last 12 months is -5.0%. Over the same period the benchmark E60B40 performance was -14.8% and -8.5% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.13% at a time when SPY gained 3.78%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $151,850 which includes $2,744 cash and excludes $2,374 spent on fees and slippage. |

|

|

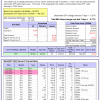

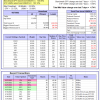

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 312.69% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 7.68% at a time when SPY gained 6.21%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $103,172 which includes $1,031 cash and excludes $1,733 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 184.46% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 7.37% at a time when SPY gained 6.21%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $71,115 which includes $1 cash and excludes $1,112 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 433.77% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 7.13% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $533,774 which includes -$4,020 cash and excludes $9,109 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 148.02% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained -1.81% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $248,022 which includes $452 cash and excludes $8,390 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 244.20% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 5.08% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $344,197 which includes $4,315 cash and excludes $5,117 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 400.53% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 4.93% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $500,525 which includes $3,925 cash and excludes $1,706 spent on fees and slippage. |

|

|

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 186.82% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 7.16% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $286,820 which includes $1,555 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 360.17% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 7.64% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $460,175 which includes $4,063 cash and excludes $7,220 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 119.66% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 6.98% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $219,659 which includes $2,578 cash and excludes $9,567 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 143.71% while the benchmark SPY gained 114.32% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 4.01% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $243,712 which includes $7,078 cash and excludes $4,637 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 18.14% while the benchmark SPY gained 11.25% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 6.57% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $118,135 which includes $40 cash and excludes $00 spent on fees and slippage. |

|

|

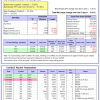

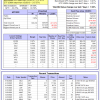

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -14.0%, and for the last 12 months is -14.1%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 2.37% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $346,337 which includes $3,669 cash and excludes $7,972 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is -4.4%, and for the last 12 months is -0.9%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.11% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $39 which includes $104,274 cash and excludes Gain to date spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -16.0%, and for the last 12 months is -15.5%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.33% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $247,000 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -26.0%, and for the last 12 months is -17.2%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of Best(SPY-SH) gained -6.77% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $65,685 which includes $790 cash and excludes $2,304 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -18.0%, and for the last 12 months is -7.4%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained -0.61% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $172,601 which includes -$1,913 cash and excludes $7,838 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -29.6%, and for the last 12 months is -21.2%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of iM-Combo5 gained -0.06% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $159,927 which includes $1,343 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -14.9%, and for the last 12 months is -7.8%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Since inception, on 7/1/2014, the model gained 172.65% while the benchmark SPY gained 130.06% and VDIGX gained 129.42% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 6.17% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $272,647 which includes $303 cash and excludes $4,356 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is -2.2%, and for the last 12 months is -0.9%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 4.97% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $212,540 which includes $3,846 cash and excludes $2,349 spent on fees and slippage. |

|

|

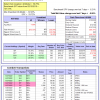

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -4.4%, and for the last 12 months is 0.1%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Since inception, on 6/30/2014, the model gained 150.76% while the benchmark SPY gained 130.06% and the ETF USMV gained 123.12% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 4.74% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $250,755 which includes $842 cash and excludes $7,530 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.5%, and for the last 12 months is 10.7%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Since inception, on 1/3/2013, the model gained 505.95% while the benchmark SPY gained 217.57% and the ETF USMV gained 217.57% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 7.06% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $605,948 which includes $2,414 cash and excludes $6,594 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -12.4%, and for the last 12 months is -12.6%. Over the same period the benchmark BND performance was -11.3% and -11.0% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.24% at a time when BND gained 0.18%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $133,014 which includes -$37 cash and excludes $2,379 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -16.0%, and for the last 12 months is -15.5%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 0.33% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $247,000 which includes -$531 cash and excludes $1,114 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is 2.4%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 6.41% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $143,413 which includes $1,074 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -10.0%, and for the last 12 months is -0.2%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 5.10% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $151,487 which includes $1,307 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -13.9%, and for the last 12 months is -3.6%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.38% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $173,302 which includes $1,914 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -2.1%, and for the last 12 months is 3.8%. Over the same period the benchmark SPY performance was -17.6% and -7.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -0.77% at a time when SPY gained 6.21%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $174,798 which includes $63 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.