|

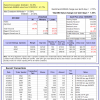

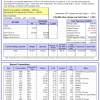

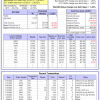

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -8.9%, and for the last 12 months is -0.5%. Over the same period the benchmark E60B40 performance was -11.0% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.30% at a time when SPY gained 2.75%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $148,412 which includes $1,725 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -9.3%, and for the last 12 months is -0.3%. Over the same period the benchmark E60B40 performance was -11.0% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained 1.29% at a time when SPY gained 2.75%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $152,572 which includes $1,876 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -9.7%, and for the last 12 months is -0.2%. Over the same period the benchmark E60B40 performance was -11.0% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained 1.29% at a time when SPY gained 2.75%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $156,554 which includes $1,966 cash and excludes $2,374 spent on fees and slippage. |

|

|

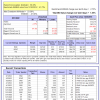

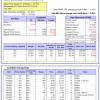

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 315.81% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained 2.82% at a time when SPY gained 4.03%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $103,952 which includes $991 cash and excludes $1,733 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 195.85% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained 4.54% at a time when SPY gained 4.03%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $73,963 which includes -$234 cash and excludes $1,109 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 497.17% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained 6.79% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $597,781 which includes -$4,871 cash and excludes $8,673 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 195.73% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 2.98% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $295,726 which includes $3,823 cash and excludes $8,257 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 271.07% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 3.25% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $371,074 which includes $2,501 cash and excludes $4,981 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 436.24% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained 3.40% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $536,241 which includes $3,047 cash and excludes $1,706 spent on fees and slippage. |

|

|

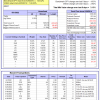

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 185.40% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained 2.81% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $285,395 which includes $1,067 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 368.82% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained 0.45% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $468,820 which includes $327 cash and excludes $7,019 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 140.48% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 2.27% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $240,478 which includes $753 cash and excludes $9,443 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 155.26% while the benchmark SPY gained 126.76% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 8.63% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $255,616 which includes -$12,628 cash and excludes $4,506 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 26.20% while the benchmark SPY gained 17.71% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 3.80% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $126,231 which includes $88 cash and excludes $00 spent on fees and slippage. |

|

|

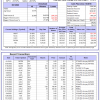

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -4.9%, and for the last 12 months is -6.6%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 5.08% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $382,731 which includes $2,215 cash and excludes $7,957 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 0.7%, and for the last 12 months is -4.3%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 0.58% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $11,170 which includes $104,253 cash and excludes Gain to date spent on fees and slippage. |

|

|

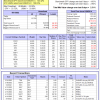

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -9.2%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 4.03% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $267,016 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -11.9%, and for the last 12 months is 0.5%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of Best(SPY-SH) gained 4.96% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $749,877 which includes -$737 cash and excludes $26,628 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -10.0%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of iM-Combo3.R1 gained 2.68% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $189,415 which includes -$821 cash and excludes $7,776 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -23.6%, and for the last 12 months is -11.4%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of iM-Combo5 gained 2.45% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $173,591 which includes -$1,755 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -11.5%, and for the last 12 months is -5.3%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Since inception, on 7/1/2014, the model gained 183.41% while the benchmark SPY gained 143.42% and VDIGX gained 140.03% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained 3.13% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $283,580 which includes $1,078 cash and excludes $4,345 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.3%, and for the last 12 months is 4.7%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained 3.26% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $226,717 which includes $2,187 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 0.1%, and for the last 12 months is 4.2%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Since inception, on 6/30/2014, the model gained 162.45% while the benchmark SPY gained 143.42% and the ETF USMV gained 129.03% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained 2.31% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $262,446 which includes $1,998 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 10.5%, and for the last 12 months is 13.6%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Since inception, on 1/3/2013, the model gained 534.93% while the benchmark SPY gained 236.02% and the ETF USMV gained 236.02% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained 3.42% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $634,926 which includes $1,830 cash and excludes $6,473 spent on fees and slippage. |

|

|

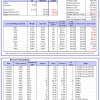

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -6.8%, and for the last 12 months is -5.9%. Over the same period the benchmark BND performance was -8.8% and -8.1% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 3.57% at a time when BND gained 0.83%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $141,580 which includes -$10 cash and excludes $2,263 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -9.2%, and for the last 12 months is -8.2%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained 4.03% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $267,016 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -5.8%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained 3.07% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $146,585 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -5.6%, and for the last 12 months is 5.0%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained 2.66% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $159,120 which includes $556 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -11.7%, and for the last 12 months is 0.7%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained 0.11% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $177,750 which includes $1,693 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is -1.4%, and for the last 12 months is -2.4%. Over the same period the benchmark SPY performance was -12.8% and -0.4% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.00% at a time when SPY gained 4.03%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $176,041 which includes $63 cash and excludes $8,560 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.