|

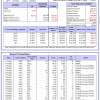

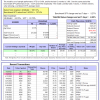

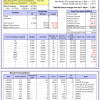

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -9.5%, and for the last 12 months is -0.5%. Over the same period the benchmark E60B40 performance was -11.3% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.70% at a time when SPY gained -2.45%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $147,358 which includes $1,611 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -9.9%, and for the last 12 months is -0.4%. Over the same period the benchmark E60B40 performance was -11.3% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -1.70% at a time when SPY gained -2.45%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $151,489 which includes $1,759 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -10.3%, and for the last 12 months is -0.3%. Over the same period the benchmark E60B40 performance was -11.3% and -3.1% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -1.70% at a time when SPY gained -2.45%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $155,443 which includes $1,846 cash and excludes $2,374 spent on fees and slippage. |

|

|

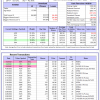

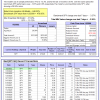

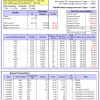

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 351.55% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -3.63% at a time when SPY gained -3.27%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $112,887 which includes -$3,797 cash and excludes $1,644 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 226.19% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -1.74% at a time when SPY gained -3.27%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $79,814 which includes -$1,475 cash and excludes $1,059 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 468.17% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -1.00% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $568,166 which includes $143 cash and excludes $8,445 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 194.53% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 0.83% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $294,533 which includes $628 cash and excludes $8,001 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 261.94% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained -6.11% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $361,938 which includes $1,210 cash and excludes $4,981 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 444.36% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -1.73% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $544,359 which includes $2,838 cash and excludes $1,706 spent on fees and slippage. |

|

|

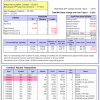

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 175.96% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -4.34% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $275,959 which includes $769 cash and excludes $1,550 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 357.60% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -1.69% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $457,598 which includes -$6,442 cash and excludes $6,856 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 127.63% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained -4.84% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $227,632 which includes $1,428 cash and excludes $9,119 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 187.00% while the benchmark SPY gained 127.61% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained -1.90% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $286,996 which includes -$415 cash and excludes $4,315 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 22.50% while the benchmark SPY gained 18.15% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained -2.98% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $122,499 which includes $497 cash and excludes $00 spent on fees and slippage. |

|

|

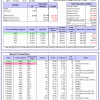

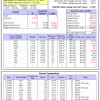

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -3.6%, and for the last 12 months is -2.1%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained -1.87% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $388,206 which includes $156 cash and excludes $7,957 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 10.9%, and for the last 12 months is 3.9%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained -0.52% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $25,116 which includes $100,120 cash and excludes Gain to date spent on fees and slippage. |

|

|

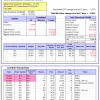

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.9%, and for the last 12 months is -7.4%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.27% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,018 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -12.3%, and for the last 12 months is 0.6%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of Best(SPY-SH) gained -3.26% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $746,019 which includes $370 cash and excludes $25,134 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -12.0%, and for the last 12 months is 1.9%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of iM-Combo3.R1 gained -2.82% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $185,356 which includes $61,828 cash and excludes $7,776 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -21.7%, and for the last 12 months is -9.5%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of iM-Combo5 gained -3.89% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $177,770 which includes $36,818 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -12.4%, and for the last 12 months is -4.0%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Since inception, on 7/1/2014, the model gained 180.50% while the benchmark SPY gained 144.33% and VDIGX gained 139.69% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -2.22% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $280,499 which includes $211 cash and excludes $4,336 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 4.0%, and for the last 12 months is 7.0%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -2.08% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $226,071 which includes $1,808 cash and excludes $2,349 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is -0.1%, and for the last 12 months is 3.6%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Since inception, on 6/30/2014, the model gained 161.93% while the benchmark SPY gained 144.33% and the ETF USMV gained 128.25% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -3.19% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $261,927 which includes $1,661 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 5.7%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Since inception, on 1/3/2013, the model gained 506.96% while the benchmark SPY gained 237.28% and the ETF USMV gained 237.28% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -0.15% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $606,961 which includes $118 cash and excludes $6,305 spent on fees and slippage. |

|

|

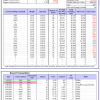

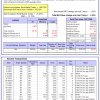

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -8.2%, and for the last 12 months is -7.4%. Over the same period the benchmark BND performance was -10.0% and -9.2% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained -1.90% at a time when BND gained -1.28%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $139,388 which includes $1,075 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -8.9%, and for the last 12 months is -7.4%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -3.27% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $268,018 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -4.6%, and for the last 12 months is 7.8%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -3.80% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $148,491 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -6.0%, and for the last 12 months is 5.2%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -4.52% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $158,279 which includes $404 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -12.9%, and for the last 12 months is 0.0%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -3.89% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $175,365 which includes $1,693 cash and excludes $4,331 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 0.0%, and for the last 12 months is 6.6%. Over the same period the benchmark SPY performance was -12.5% and 0.6% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained -1.94% at a time when SPY gained -3.27%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $178,630 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.