|

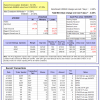

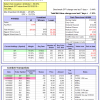

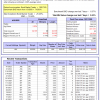

Out of sample performance summary of our models for the past 1, 2, 4 and 13 week periods. The active active return indicates how the models over- or underperformed the benchmark ETF SPY. Also the YTD, and the 1-, 3-, 5- and 10-year annualized returns are shown in the second table |

|

|

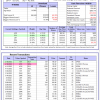

iM-FlipSaver 60:40 | 20:80 – 2017: The model’s out of sample performance YTD is -7.9%, and for the last 12 months is 1.4%. Over the same period the benchmark E60B40 performance was -7.9% and 0.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.48% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 7/16/2015 would have grown to $149,979 which includes $1,118 cash and excludes $2,097 spent on fees and slippage. |

|

|

iM-FlipSaver 70:30 | 20:80 – 2017: The model’s out of sample performance YTD is -8.3%, and for the last 12 months is 1.5%. Over the same period the benchmark E60B40 performance was -7.9% and 0.7% respectively. Over the previous week the market value of iM-FlipSaver 70:30 | 20:80 gained -0.48% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 7/15/2015 would have grown to $154,181 which includes $1,253 cash and excludes $2,238 spent on fees and slippage. |

|

|

iM-FlipSaver 80:20 | 20:80 – 2017: The model’s out of sample performance YTD is -8.7%, and for the last 12 months is 1.5%. Over the same period the benchmark E60B40 performance was -7.9% and 0.7% respectively. Over the previous week the market value of iM-FlipSaver 80:20 | 20:80 gained -0.48% at a time when SPY gained -0.49%. A starting capital of $100,000 at inception on 1/2/2017 would have grown to $158,204 which includes $1,327 cash and excludes $2,374 spent on fees and slippage. |

|

|

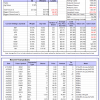

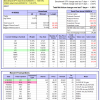

iM-5HedgeFundSelect: Since inception, on 1/5/2016, the model gained 376.47% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-5HedgeFundSelect gained -1.26% at a time when SPY gained -0.44%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $119,117 which includes -$3,797 cash and excludes $1,644 spent on fees and slippage. |

|

|

iM-10LargeHedgeFundSelect: Since inception, on 1/5/2016, the model gained 251.79% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-10LargeHedgeFundSelect gained -1.77% at a time when SPY gained -0.44%. A starting capital of $25,000 at inception on 1/5/2016 would have grown to $87,948 which includes $298 cash and excludes $1,052 spent on fees and slippage. |

|

|

iM-Top5(QQQ)Select: Since inception, on 1/5/2016, the model gained 475.23% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(QQQ)Select gained -0.16% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $575,232 which includes $143 cash and excludes $8,445 spent on fees and slippage. |

|

|

iM-Top5(XLB)Select: Since inception, on 1/5/2016, the model gained 197.94% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLB)Select gained 6.04% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $297,936 which includes $314 cash and excludes $7,874 spent on fees and slippage. |

|

|

iM-Top5(XLI)Select: Since inception, on 1/5/2016, the model gained 282.13% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLI)Select gained 0.34% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $382,128 which includes -$11,262 cash and excludes $4,825 spent on fees and slippage. |

|

|

iM-Top5(XLK)Select: Since inception, on 1/5/2016, the model gained 453.92% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLK)Select gained -1.33% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $553,919 which includes $2,838 cash and excludes $1,706 spent on fees and slippage. |

|

|

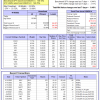

iM-Top5(XLP)Select: Since inception, on 1/5/2016, the model gained 179.81% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLP)Select gained -0.59% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $279,806 which includes $2,046 cash and excludes $1,532 spent on fees and slippage. |

|

|

iM-Top5(XLV)Select: Since inception, on 1/5/2016, the model gained 377.95% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLV)Select gained -2.75% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $477,952 which includes $7,123 cash and excludes $6,641 spent on fees and slippage. |

|

|

iM-Top5(XLU)Select: Since inception, on 1/5/2016, the model gained 140.12% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLU)Select gained 0.31% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $240,119 which includes $801 cash and excludes $8,983 spent on fees and slippage. |

|

|

iM-Top5(XLY)Select: Since inception, on 1/5/2016, the model gained 189.83% while the benchmark SPY gained 140.51% over the same period. Over the previous week the market value of iM-Top5(XLY)Select gained 1.41% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/5/2016 would have grown to $289,832 which includes -$415 cash and excludes $4,315 spent on fees and slippage. |

|

|

iM-Seasonal Super-Sectors (Top5 combo) : Since inception, on 11/17/2020, the model gained 27.31% while the benchmark SPY gained 24.85% over the same period. Over the previous week the market value of iM-Seasonal Super-Sectors (Top5 combo) gained 1.28% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 11/17/2020 would have grown to $127,305 which includes $932 cash and excludes $00 spent on fees and slippage. |

|

|

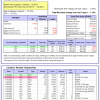

iM-Dividend Growth Portfolio: The model’s out of sample performance YTD is -0.8%, and for the last 12 months is -1.8%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM-Dividend Growth Portfolio gained 0.10% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $399,279 which includes $1,768 cash and excludes $7,759 spent on fees and slippage. |

|

|

iM-Gold Momentum Timer (AU, NEM, SBSW): The model’s out of sample performance YTD is 31.2%, and for the last 12 months is 12.0%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of iM-Gold Momentum Timer (AU, NEM, SBSW) gained 5.02% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $32 which includes $95,460 cash and excludes Gain to date spent on fees and slippage. |

|

|

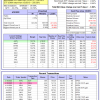

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.7%, and for the last 12 months is -2.1%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.44% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $283,192 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best(SPY-SH).R1: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of Best(SPY-SH) gained -0.44% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/2/2009 would have grown to $788,127 which includes $2,847 cash and excludes $25,132 spent on fees and slippage. |

|

|

iM-Combo3.R1: The model’s out of sample performance YTD is -8.3%, and for the last 12 months is 5.3%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of iM-Combo3.R1 gained -1.18% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 2/3/2014 would have grown to $193,115 which includes $1,658 cash and excludes $7,710 spent on fees and slippage. |

|

|

iM-Combo5: The model’s out of sample performance YTD is -16.7%, and for the last 12 months is -4.6%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of iM-Combo5 gained -1.10% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 2/22/2016 would have grown to $189,314 which includes -$166 cash and excludes $0 spent on fees and slippage. |

|

|

iM-Best10(VDIGX)-Trader: The model’s out of sample performance YTD is -9.0%, and for the last 12 months is -1.9%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Since inception, on 7/1/2014, the model gained 191.28% while the benchmark SPY gained 158.18% and VDIGX gained 149.37% over the same period. Over the previous week the market value of iM-Best10(VDIGX) gained -1.93% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 7/1/2014 would have grown to $291,283 which includes $211 cash and excludes $4,336 spent on fees and slippage. |

|

|

iM 6-Stock Capital Strength Portfolio: The model’s out of sample performance YTD is 3.6%, and for the last 12 months is 4.5%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM 6-Stock Capital Strength Portfolio gained -0.65% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 10/28/2016 would have grown to $225,280 which includes $2,705 cash and excludes $2,171 spent on fees and slippage. |

|

|

iM-Best12(USMV)-Trader: The model’s out of sample performance YTD is 3.9%, and for the last 12 months is 4.4%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Since inception, on 6/30/2014, the model gained 172.41% while the benchmark SPY gained 158.18% and the ETF USMV gained 140.78% over the same period. Over the previous week the market value of iM-Best12(USMV)-Trader gained -0.46% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2014 would have grown to $272,411 which includes $1,661 cash and excludes $7,509 spent on fees and slippage. |

|

|

iM-Min Volatility(USMV) Investor (Tax Efficient): The model’s out of sample performance YTD is 8.4%, and for the last 12 months is 12.8%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Since inception, on 1/3/2013, the model gained 522.73% while the benchmark SPY gained 256.39% and the ETF USMV gained 256.39% over the same period. Over the previous week the market value of iM-Best12(USMV)Q1 gained -1.89% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/3/2013 would have grown to $622,732 which includes $118 cash and excludes $6,305 spent on fees and slippage. |

|

|

iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond): The model’s out of sample performance YTD is -6.1%, and for the last 12 months is -5.1%. Over the same period the benchmark BND performance was -8.9% and -7.9% respectively. Over the previous week the market value of the iM-Bond Market Trader (High-Yield Bond or 10-yr Treasury Bond) gained 0.53% at a time when BND gained -0.57%. A starting capital of $10,000 at inception on 1/3/2000 would have grown to $142,600 which includes $485 cash and excludes $2,203 spent on fees and slippage. |

|

|

iM-ModSum/YieldCurve Timer: The model’s out of sample performance YTD is -3.7%, and for the last 12 months is -2.1%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of iM-PortSum/YieldCurve Timer gained -0.44% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 1/1/2016 would have grown to $283,192 which includes $264 cash and excludes $950 spent on fees and slippage. |

|

|

iM-Best2 MC-Score ETF System: The model’s out of sample performance YTD is -1.1%, and for the last 12 months is 11.4%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM-Best2 MC-Score ETF System gained -0.71% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $153,988 which includes $344 cash and excludes $1,394 spent on fees and slippage. |

|

|

iM-Best4 MC-Score Vanguard System: The model’s out of sample performance YTD is -1.4%, and for the last 12 months is 11.2%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM-Best4 MC-Score Vanguard System gained -0.29% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $165,991 which includes $247 cash and excludes $00 spent on fees and slippage. |

|

|

iM-Composite (SPY-IEF) Timer: The model’s out of sample performance YTD is -7.4%, and for the last 12 months is 6.3%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM-Composite (SPY-IEF) Timer gained -0.43% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $186,403 which includes $4,207 cash and excludes $3,984 spent on fees and slippage. |

|

|

iM-Composite(Gold-Stocks-Bond) Timer: The model’s out of sample performance YTD is 6.4%, and for the last 12 months is 12.9%. Over the same period the benchmark SPY performance was -7.5% and 6.3% respectively. Over the previous week the market value of the iM-Composite(Gold-Stocks-Bond) Timer gained 1.23% at a time when SPY gained -0.44%. A starting capital of $100,000 at inception on 6/30/2016 would have grown to $190,010 which includes -$1,992 cash and excludes $8,558 spent on fees and slippage. |

Leave a Reply

You must be logged in to post a comment.